- The Ultimate Oscillator is a momentum indicator.

- It integrates three various times within one value.

- It directs traders on how to better time their entry and exits in the market.

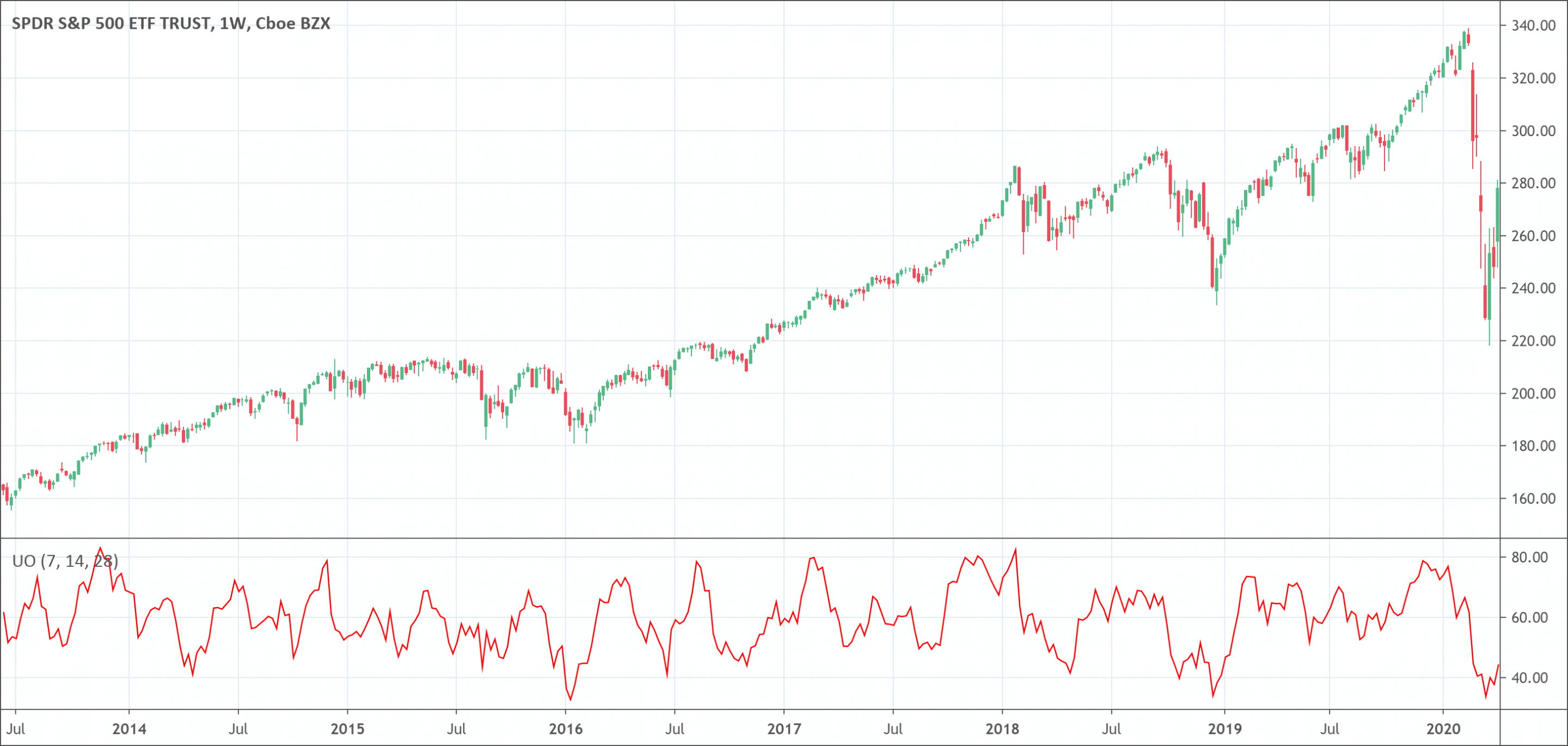

The ultimate oscillator is a momentum indicator. It grabs momentum across three various timeframes. The multiple timeframe objective aims to prevent the pitfalls of other indicators. Most momentum indicators surge at the start of a strong advance, only to make a bearish divergence as the advance continues. This is because they focus only on one timeframe.

The oscillator tries to correct this fault by applying longer timeframes into the basic formula. The buy signal is based on a bullish divergence and a sell signal based on a bearish divergence.

Ultimate oscillator integrates three various times within one value. The tool hopes to decrease the sensitivity of momentum oscillators to recent data and instead focus better on long trends.

It intends to do this by considering various periods and making use of an elaborate decision mechanism. Investors, particularly those that dabble in active investment, will do well to use this oscillator in their investment decision making.

What is the Ultimate Oscillator?

The ultimate oscillator is a technical indicator some traders use to maximize returns from price momentum analysis. It is an indicator, like the relative strength indicator (RSI), that direct traders on how to better time their entry and exits in the market.

This is important so they can maximize the returns on their investments. But unlike other momentum oscillators, this indicator makes use of three various time frames before generating the buy or sell signals within the market.

Taking three different timeframes makes it possible for the oscillator to integrate short-term and long-term analysis into one measure.

The problem with many momentum oscillators is that after a rapid advance or decline in price, they can create false divergence trading signals. For instance, after a sudden rise in price, a bearish divergence signal may form, but the price keeps on rising.

The ultimate oscillator tries to correct this by making use of various timeframes in its calculation rather than just one timeframe which is what most other momentum oscillators use.

An ultimate oscillator has a value between 0-100. It will generate buy and sell signals based on divergences between the oscillator and the price candles. When compared with other indicators, this measure creates less buy and sell signals.

Different periods

The ultimate oscillator indicator joins short-term, intermediate-term, and long-term price action into one oscillator. It tries to give overbought and oversold readings, potential buy and sell signals, and confirmations of price action. It also gives divergences that might warn of future price reversals.

- Short-term: The short-term indicator peaks earlier than price action peaks (usually 7-period).

- Intermediate-term: It responds averagely to reversals in price action (usually 14-period).

- Long-term: It is late in responding to reversals in price action (usually 28-period).

By combining three various periods, the indicator tends to peak when the price peaks. The intermediate and long-term include the short-term period; thus, the short-term period has more heavy weight in the equation.

The ultimate oscillator indicator is mostly used to detect divergences and give potential buy or sell signals based on those divergences.

Who created the Ultimate Oscillator?

Larry Williams created the indicator in 1976. The 1970s was ideal for introducing new technical indicators that have since become an indispensable part of the toolbox of any good investor.

Williams was one of the best stocks and commodity traders in the ’70s. He shared his ideas with the “World Stocks & Commodities Magazine” in 1985. Since then, the ultimate oscillator has gained fame as a tool that redeems a lot of bad qualities of other oscillators.

The differences with other indicators

For traders that know about momentum oscillators, the ultimate oscillator mostly looks like other oscillators such as RSI and stochastic oscillators, on the surface. But they differ from other momentum oscillators in some important ways.

Use of multiple periods

They make use of three various times for their measures rather than one. In contrast, stochastic and RSI oscillators make use of single time frame measures. This difference makes it possible for them to integrate short-term and long-term analysis into one compound measure.

Different buy and sell signals

Although both the measures use divergence to create buy and sell signals, the actual markers for buy and sell signals will differ. The ultimate oscillator will give various buy and sell signals for the same data. They do this because their formula differs compared to the stochastic oscillator and RSI indicator.

For instance, for the RSI indicator, only the absolute value is used to create the buy and sell signals for the investor. RSI works on the method of an asset being over-bought or over-sold. If a stock is over-sold, the market is expected to realize this in a short while and buy the asset. This will increase the price of the asset.

What does the Ultimate Oscillator tell traders?

The indicator is range-bound, having a value that fluctuates between 0 and 100. Similar to the RSI levels lower than 30 are seen to be oversold, and levels above 70 are seen to be overbought. Trading signals are made when the price goes in the opposite direction as the oscillator, and depend on a three-step method.

It is common to notice false divergences in oscillators that only use one timeframe, because when the price surges the oscillator surges. Even if the price keeps on rising, the oscillator falls, forming a divergence, even though the price may still be trending strongly.

The three-step approach

- For the indicator to create a buy signal, Williams suggested a three-step approach.

- A bullish divergence has to form. This is when the price makes a lower low but the indicator is at a higher low.

- The first low in the divergence has to have been below 30. This means the divergence began from oversold territory and will probably lead to an upside price reversal.

- The ultimate oscillator has to rise higher than the high of the divergence. The divergence high is the high point between the two lows of the divergence.

How to use it in trading?

The ultimate oscillator indicator can be used as a measure of buying/selling pressure. The general rule tells the following:

- When the buying pressure is strong, the indicators will go up.

- When the buying pressure weakens, the indicators go down.

A divergence is the difference in the direction of the general trend and the oscillator itself. When the prices make new lows and the indicator doesn’t, a bullish divergence is seen. When the prices make a higher high and the indicator doesn’t, a bearish divergence is formed.

The difference between the Ultimate Oscillator and Stochastic Oscillator

- The ultimate oscillator indicator has three timeframes.

- The stochastic oscillator has only one. Typically, the ultimate oscillator does not include a signal line, while the stochastic does.

- Even though both indicators create trade signals based on divergence, the signals will be different because of the different calculations.

- Also, the ultimate oscillator makes use of a three-step method for trading divergence.

Limitations of using the Ultimate Oscillator

Although the three-step trading method for the indicator may help get rid of some poor trades, it also eliminates a lot of good ones. Divergence cannot be seen at all price reversal points. Additionally, a reversal will not always come from overbought or oversold places.

Waiting for the oscillator to move above the divergence high (bullish divergence) or below the divergence low (bearish divergence) could mean a poor entry point. This is so because the price may have already run significantly in the reversal direction.

In conclusion

Just as it is with all technical indicators, traders should not use the ultimate oscillator in isolation, but rather as part of a complete trading plan. Such a plan has to include other forms of analysis like price analysis, other technical indicators, and/or fundamental analysis.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!