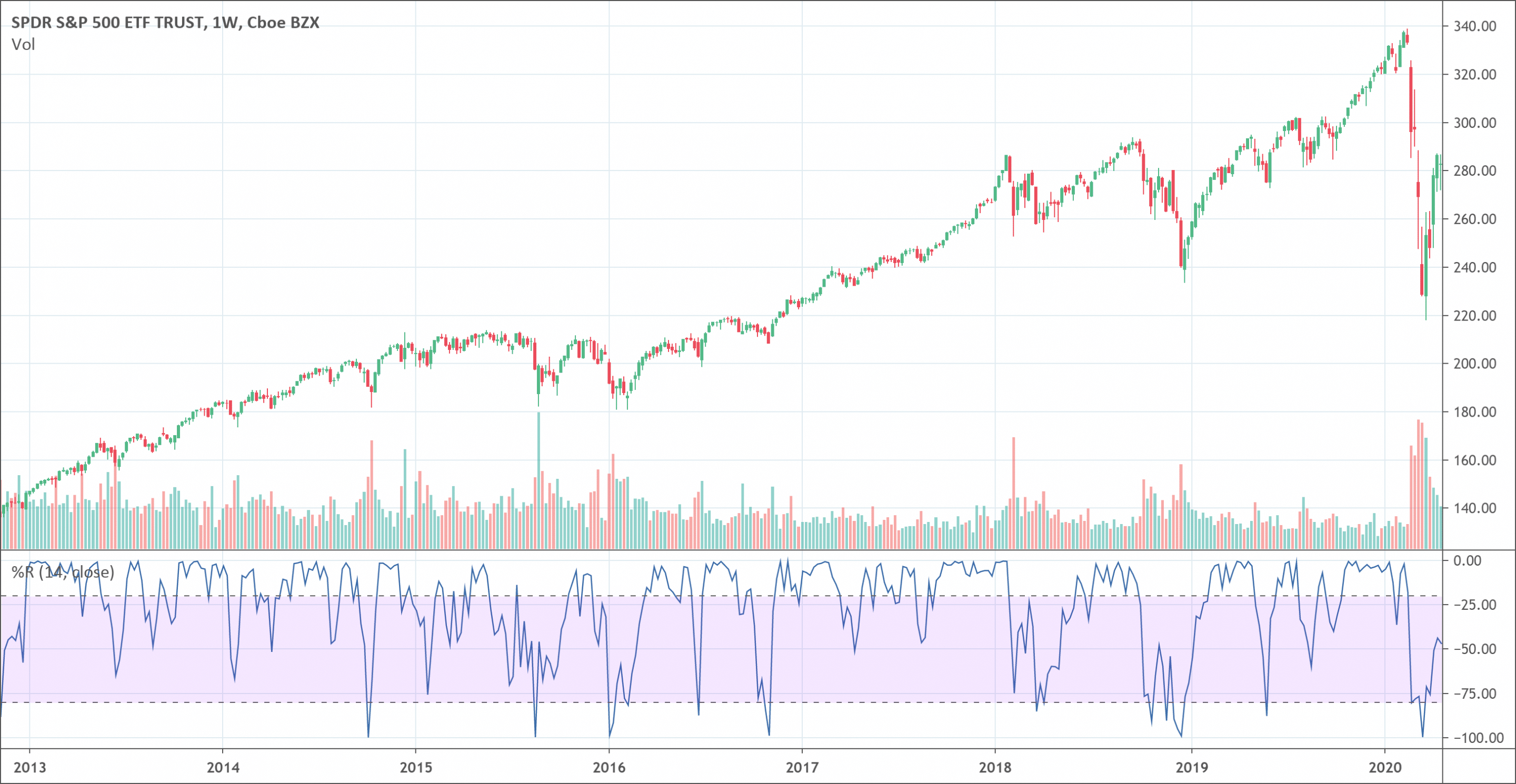

- The Williams %R indicator oscillates between 0 and -100.

- When its value is above -20, it sends an overbought signal.

- When its value is below -80, it sends an oversold signal.

- Overbought and oversold signals are clues the price is reaching extremes.

What is the Williams %R indicator?

Williams %R, also known as the Williams Percentage Range or simply %R is a popular momentum indicator. It oscillates between 0 (highest) to -100 (lowest).

Larry Williams created it, and he was a famous technical analyst and an author of books and trading articles. The Williams %R is closely relates to the Stochastic Oscillator. Both apply in a similar manner over a space of 14 days or period.

The major attribute of the Williams %R, and the major reason why it is so famous, is its capability to show that price reversal will occur when a candle or two just before the price actually does.

Before we proceed on our learning of Williams Percentage Range, let us define a few terms to strengthen our understanding and eliminate any confusion.

- Overbought: This is term used for scenarios where demand is overly high. It makes the price attain an extremely high (unsustainable) rate. And in turn causing an oscillator to reach upper heights. A stock or an asset is overbought when the %R reaches between 0 to -20%.

- Oversold: This refers to a scenario when the price has reached a much lower level than its normal rate. It results in the oscillator reaching a low level. A stock is oversold when the %R reaches between -80 to -100.

- Williams Percentage Range: It is a momentum indicator that ranges between 0 to -100. Two horizontal lines are added to denotes -20 and -80 by default. It determines overbought (0 to -20%) and oversold (-80 to -100%) point by finding the close of the candles relative to the range among the largest and smallest price of a specific time. And this time or period by default is usually 14 in the Meta-trader platform, and this gave rise to the 14 Period Williams %R.

How to Use Williams %R?

Williams %R as a momentum indicator is used to determine the levels of overbought and oversold of a stock. A reading above -20 is overbought while a reading below -80 is considered as oversold. Overbought simply denotes that the price is near highs of its recent range, and Oversold denotes that the price is near lows of its recent range. It is used to obtain trade signals when both the price and indicator moves out of overbought and oversold region.

In a case of an uptrend, traders can observe the Williams %R indicator to go below the mark of -80. When the price starts rising, and the indicator rises back above the mark of -80, it could indicate that the uptrend in price is beginning again.

The same idea is applicable for trading in a downtrend. When the Williams %R indicator is beyond the mark of -20, observe the price to start diminishing alongside the Williams %R going back below the mark -20 to indicate a possible continuation in the downtrend.

Traders could as well observe the momentum failures. In a case of a strong uptrend, the price will often rise to the mark of -20 or beyond. If the indicator goes down, and is not able to rise above the mark of -20 before falling again, that indicates that the upward price momentum is in problem and a larger price decline could follow.

The case is the same for a downtrend where readings at the mark of -80 or below are often reached. If the indicator is not able to reach the low mark levels before rising up, it could signal the price is going to shoot up.

The formula for the Williams %R indicator

%R = (Highest High n days – Close current period) / (Highest High n days – Lowest Low n days) * -100

How to calculate the Williams %R

You can calculate the Williams %R by using price and that can be carried out over the last 14 days or periods.

- Save the high and low for each period over the space of 14 periods.

- Record the current price, the highest price, and lowest price on the 14thperiod. At this point, you can refer to the formula to make the necessary substitute.

- Record the current price, highest price on the 15th period, and lowest price for the last 14 periods excluding the 15thperiod. Calculate the Williams %R value.

- Calculate the new Williams %R at the close of each period by using only the values of the last 14 periods.

Similarities between Williams %R and Stochastic Oscillator

The Williams %R oscillates between 0 and -100. It shows the level of the close of a market in relation to the highest high for the look back period. On the other hand, the Fast Stochastic Oscillator moves between 0 and 100. It gives the close level of a market in relation to the lowest low.

Both the Williams %R and the Fast Stochastic Oscillator usually wind up at almost the same indicator. One thing that differentiates them from each other is the scale of their indicators.

Unlike the Stochastic Oscillator, the Williams Percentage Range has a reversed scale but lacks an internal smoothing component. It shows relationship between the closing price and the price range for a specific time.

Cons of using the Williams %R

Overbought and oversold marking on the indicator does not denote an occurrence of a reversal. Overbought marking is used to determine an uptrend, considering that a strong uptrend frequently see prices which are shooting to or beyond prior heights.

Also, the indicator can be extremely responsive, which means it leads to numerous wrong signals. For instance, the indicator may be in the oversold region and start rising, but the price failing to do the same. This is as a result of the indicator only observing the last 14 days or periods. As period progresses, the current price relative to the big and small in the look back time changes, even when the price has failed to move.

Conclusion

It is not enough to only have the knowledge of if a financial instrument is overbought. You should consider the probability that it has reached such levels as price may not immediately reverse. It is possible that it is only the start of a strongly trending market. Also, it is possible for Williams %R to move below the overbought mark only to move back above it again.

Considering the fact that Williams %R indicator is similar to the Fast Stochastic Oscillator, one could simply want to opt for the Stochastic Oscillator. But, it should be noted that the intended trading strategy of the Williams %R is totally different from the Stochastic Oscillator.

The Williams Percentage Range is a popularly momentum indicator. It helps traders determine the point of the closing price in regards to the price range of a particular period. This is an important indicator which helps us to know overbought or oversold conditions. It warns traders in advance to expect price reversals. Immediately after price reversal confirms, necessary action can be put in place.

Just like with other indicators, The Williams %R is not perfect and traders should not use it as the only indicator for making decision. Nonetheless there is higher ratio of positive and tremendously great trading profit when used rightly alongside with other indicators. It is in respect that the Williams %R is more popular among traders.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!