- Wyckoff’s method or Wyckoff’s theory is one of the most complete and valuable trading theory.

- Wyckoff’s theory helps trader understand major market swings (accumulation, distribution phases).

- Despite all the limitations of the Wyckoff’s method, no one can deny the fact the Wyckoff’s price cycle, Wyckoff’s laws, and overall rules are great concepts for analyzing and understanding the market and its behavior.

Huge multinational companies like McDonald’s and Walmart are tremendously successful because they strictly follow their business plans. They have a trading strategy in place and they follow it consistently. They only deviate from their business plan and strategy only when the modifications in the business plan and strategy are completed ahead of time. These companies modify their plans and strategies when the previous plan is outdated with economic changes, when it is time to try new ways to increase profits, or if a plan or a part of a plan isn’t working. Similarly, trading is a business that traders must deal with in a similar fashion. Richard D. Wyckoff was a stock trader who developed a business plan of his own for trading and the rest is history. Let’s deep dive into the Wyckoff’s principles.

Who was Richard D. Wyckoff?

Richard Wyckoff was a pioneer in the field of studying the stock market. In the early 20th century, he developed a technical approach to study the stock market. He is one of the five titans of technical analysis along with Merrill, Elliot, Dow, and Gann. His success story as a stock market trader is interesting as well as astonishing. He achieved all in his teenage that many couldn’t in their entire life. Amazingly, at the age of just fifteen, he was a stock runner for a New York brokerage firm. He became the head of that firm when he was in his 20s. He was also the founder of The Magazine of Wall Street that he wrote and edited for nearly two decades.

Wyckoff was a very intelligent and shrewd trader. He was a keen observer and student of the stock market. Richard wasn’t just the observer of the campaigns of other master stock market operators of his time rather he studied the stock market and its activities himself. He was such a keen student of the stock market that he successfully codified the best practices and trading styles of legendary stock operators like Jesse Livermore and JP Morgan into trading techniques, principles, and laws.

Another striking aspect of Wyckoff’s personality was his dedication to the public. He began to instruct and teach the public about the real techniques of stock trading. For this sole reason, he founded a school in the 1930s that later became the Stock Market Institute. He offered a course that integrated the techniques and concepts that he had learned himself. The course was about identifying large operators’ accumulation and distribution of stock and how to take positions. His learnings, concepts, and time-tested insights are valid even today as they were nearly 100 years ago.

What is the Wyckoff method?

Volume and the analysis of the stock prices are the basis of Wyckoff’s technical analysis method. Wyckoff never used technical indicators and clear rules. He favored the analysis of charts and supply and demand dynamics. The Wyckoff’s method also relies on uncovering intentions of the big traders and Wyckoff named those players the Composite Men. The followers of Wyckoff’s method observe how the big players accumulate assets at the bottom and sell them off at the top. Wyckoff’s method has become so popular because it relies on just two indicators, volume and stock prices, that are instantaneous, lively, and do not lag behind like other indicators.

The following are the five simple steps of Wyckoff’s theory of technical analysis for decision making.

- Analyze the bar and point-and-figure charts of the indexes, determine the present position and possible future trend in the market, and then decide how to take position.

- Choose the stocks that are going in harmony with the market. Select those stocks for trading that same stronger than the market.

- Choose only those stocks for trading that have the potential to exceed or equal the minimum objectives. Select those stocks that fall under the accumulation or re-accumulation areas.

- Rank stocks according to their readiness to move and trader’s preferences.

- Commit with the turn in the indexes, place stop-loss, follow-through until the market position is closed.

A great video course about the Wyckoff theory can be found on Udemy.

It’s called “Wyckoff Trading: Making Profits With Demand And Supply” and explains clearly accumulation and distribution mecanisms.

Click here to go check it out and follow the course!

The foundations of the Wyckoff method

The Wyckoff method of trading or Wyckoff theory relies on two main rules or concepts:

- the price action

- and market cycles

These are the two important pillars of the Wyckoff method.

Rule 1

The price action never follows the same course as it did in the past and that makes the market never behave the same way. Every move of the market is unique.

Rule 2

As every move of the price action and market is unique, its analytical importance relies on its comparison to past behavior.

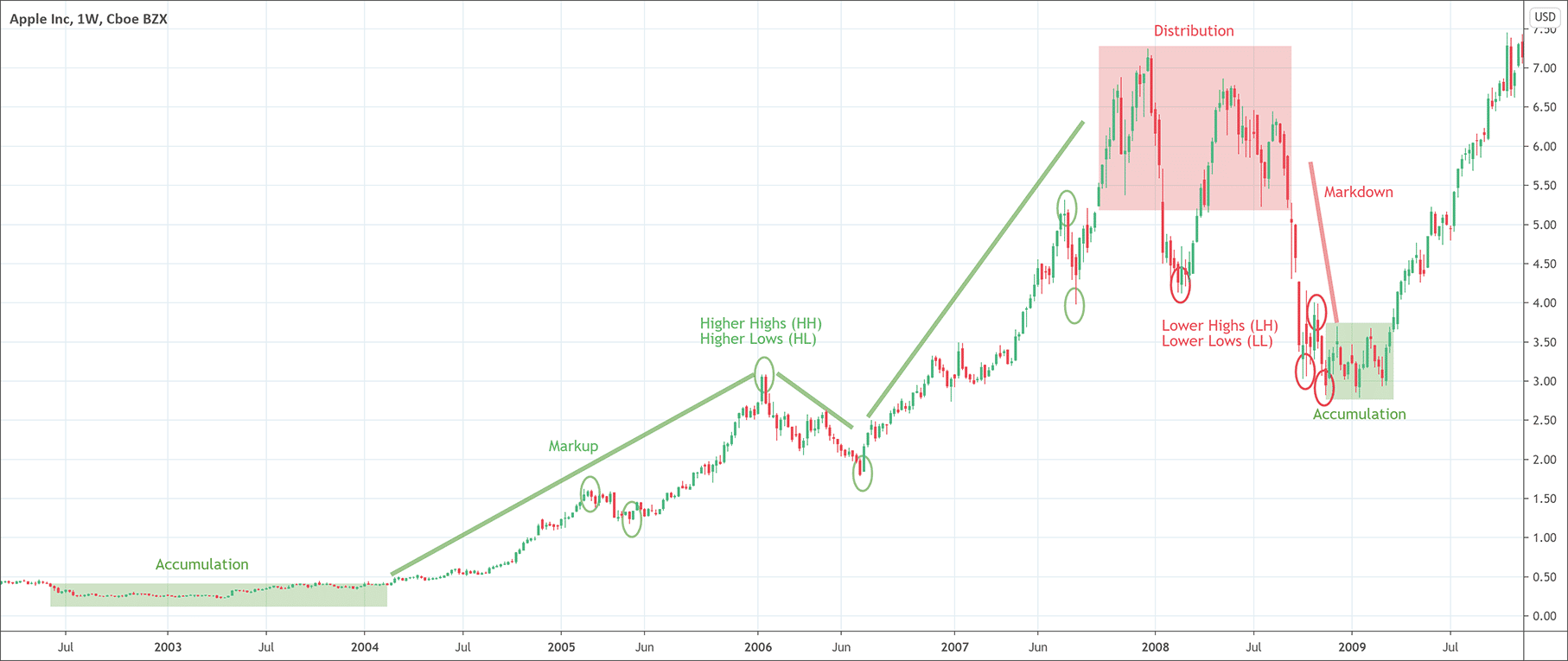

Wyckoff’s market cycles or price cycles

Wyckoff’s market cycles or price cycles are his major contribution. Price cycle is an algorithm that constructs a relationship between price changes, market phases, and institutional money flows. His price action market cycle theory is still one of the most popular trading practices today. According to Wyckoff’s price cycle, the price cycle of an instrument consists of the following four stages. Once the price cycle is complete, the entire cycle repeats starting from the first accumulation phase.

1. Accumulation phase

The first stage of Wyckoff’s price cycle is the accumulation phase. Increased institutional demands cause the accumulation phase. During the accumulation phase, bulls try to push prices high by showing gaining power. Despite the unchallenged authority, the price action on the chart remains flat. That means a ranging price structure on the chart illustrates the process of accumulation. Higher bottoms within the range indicate that the price action has entered the accumulation phase.

2. Markup phase

The second phase of Wyckoff’s price cycle is the markup phase. During this phase, bulls gain significant power that enables them to push prices through the upper level of the range. The price cycle touching the upper level of the range indicates that the price action is currently in the markup phase. During this phase, the bullish price trend appears on the chart.

3. Distribution phase

The third phase of the Wyckoff’s price cycle is the distribution phase. This is the phase where the bearish activity begins. Bears try to regain power during the distribution phase. The price action at this stage appears flat on the chart as it was during the accumulation phase. The consistent failure of the prices to create higher bottoms on the chart indicates that the price cycle has entered the distribution phase. The appearance of the lower tops shows that the market is facing a selloff.

4. Markdown phase

The fourth and the last phase of the Wyckoff’s price cycle is the markdown phase. The beginning of the downtrend after the distribution phase starts the markdown phase. When the price action is successful in breaking the lower levels of the flat range of the chart’s horizontal distribution channel, it is the confirmation of the markdown phase. The Markdown phase indicates that bears have gained enough control of the market to push the market in the bearish direction.

Accumulation /distribution price spring

It is very important to note that sometimes the price action dips below the accumulation channel and goes above the distribution channel before the creation of the real breakout. This occurrence is actually a false breakout and is called a Wyckoff spring. Wyckoff spring also acts as another confirmation signal that the price action is following the Wyckoff’s price cycle or market cycle. Traders often associate Wyckoff spring with stop running wherein the organizations take prices to obvious stop-loss areas in search of the required liquidity levels to fulfill their orders.

The three of Wyckoff’s laws

Another significant contribution of Wyckoff to the technical analysis of the stock market is his three laws known as Wyckoff’s laws.

The Wyckoff’s law of supply and demand

The first of Wyckoff’s laws is the law of supply and demand. The law states that demand greater than supply rises prices and demand lower than supply causes a fall of prices. The excess demand makes prices rise because there are more traders buying than selling. Conversely, the prices decline when traders are willing to sell but there are no buyers in the market. The technical analysts observe the balance of price between the supply and demand by comparing price and volume bars on the chart over different time periods. The law is simple but it takes time and practice to quantify supply and demand on bar charts and to understand trading the supply and demand.

The Wyckoff’s law of cause and effect

The second of Wyckoff’s laws is the law of cause and effect. The law states that the supply and demand difference is not random. Rather, the difference is the result of specific events. According to Wyckoff’s terms, the period of accumulation causes an uptrend while the period of distribution causes a downtrend. The law of cause and effect acts as a kind of filter for the traders to set price targets. They do so by analyzing the magnitude of a price trend breaking out from a trading range. Wyckoff’s cause is the count of horizontal points in a Point and Figure chart. Wyckoff’s effect is the distance price moves as per the points count.

In fact, the law of cause and effect is the power of accumulation or distribution inside a price trading range. The law tries to project how this power of accumulation and distribution will play out in the upcoming trend. In the simplest of words, the Point and Figure chart can be used to quantify a cause and project the level of its effect.

The Wyckoff’s law of effort and result

The third law of Wyckoff’s laws is the law of effort v result. According to the law, the changes in the price of an asset are a result of an effort. The trading volume represents that effort. The harmony between the price action and the volume suggests that there are strong chances of the continuation of the trend. However, the divergence between the price and volume indicates a potential reversal of the current trend in the market. Hence, the law of effort v result acts as a kind of warning signal of an upcoming change in the direction of the current trend. Large efforts represented by high volumes v small price range bars after big upwards movements in prices and prices failing to mark new highs showing no results means that traders are selling shares and distribution makes traders believe a reversal of trend is near.

Wyckoff’s Composite Man

Principle

Composite Man is a heuristic device proposed by Wyckoff. The idea of the Composite Man was to create an imaginary identity of the market. The Composite Man, in reality, represents the big players in the market such as rich individual and institutional investors. The purpose of the Composite Man is to help traders understand individual stock’s price movement and the overall market. Wyckoff had the opinion that traders should study all the fluctuations in the market as well as the price movements of all the various stocks. He advised traders to play the market game just like the Composite Man. He states that the Composite Man, in theory, acts behind the scene and manipulates the market to the disadvantage of the traders if they do not understand the market game. Conversely, it acts to traders’ greatest advantage if traders truly understand the market game.

Wyckoff always wanted retail investors to trade just like the Composite Man. However, what he found was that the behavior of retail traders was always the opposite of the Composite Man. However, he iterated that the strategy of the Composite Man is somewhat predictable, and retail traders can learn from that strategy. The strategy of a Composite Man can be analyzed by using the four price cycles.

Four price cycles

- During the accumulation phase, the Composite Man focuses on gradually accumulating the assets before most investors to avoid the significant price movement.

- During the markup phase or uptrend, the Composite Man has accumulated enough assets, is able to deplete the selling force, and starts pushing the market up.

- While in the distribution phase, the Composite Man starts distribution of his assets and sells his profitable positions to investors entering the market at the late stages.

- During the markdown or downtrend, the Composite Man starts pushing the market down after being able to sell the majority of his shares.

Want to know even more about Wyckoff’s method?

Check out this course on Udemy: Wyckoff Trading: Making Profits With Demand And Supply.

It’ll explain in an hour and a half videos all the theory and 2 pratical applications. Inside accumulation and inside distribution while no longer hold any secrets to you.

Click here to start the course now!

How to use Wyckoff’s theory to make a profit in trading?

Wyckoff’s price cycle is one of the most useful concepts in Wyckoff’s theory that can help traders to easily determine the upcoming moves of the prices. How does the Wyckoff’s price cycle help? Let us understand it by an example. The end of the accumulation phase indicates that the beginning of the markup phase is near and traders can use it to trade to the long side. That means the complete and thorough understanding of Wyckoff’s price cycle is absolutely imperative to take the best position for the upcoming price tendency.

The execution of a good Wyckoff trading strategy requires to recognize the market cycle first after performing Wyckoff analysis. Traders also need a perfect trading plan in place to take full advantage of the current cycle. The following are some rules of the Wyckoff’s trading strategy that can assist traders to enter and manage trades within the Wyckoff’s price cycle.

Entry

Transition of the price action from accumulation to markup and from the distribution to markdown are the important points to enter a trade. First of all, traders must determine the current stage of the market when the forex market is ranging. Analysis of the previous price move is very helpful in this regard. When the price breaks out of the range in the direction of the predicted move, enter the trade. Simply, traders can buy the stock when prices break through the upper level and sell when prices break through the distribution range’s lower support.

Stop-loss

Placing a stop-loss is the most prudent plan in forex trading to remain at a safe end. While using Wyckoff’s theory, it is a good strategy to place stop-loss below the lowest point of the accumulation stage when trading a markup. In order to trade a markdown, place a stop-loss above the highest point during the distribution stage.

Take profit

The price action analysis is extremely helpful in managing to take profit points. Let us understand it through some examples. Suppose that there are descending tops on the chart. It is the indication that price is switching from markup to a distribution stage. Traders exit the trade if they would spot the Wyckoff spring because the price action has entered the late stage of the distribution stage. It is crystal clear that Wyckoff’s analysis and the price action work proceed in a similar fashion. Therefore, the price action analysis should always be the first step for initiating and managing trades within the Wyckoff’s price cycle. However, traders should be flexible in their approach to price action analysis. They should always be open to the current market situation. And finally, traders must act in accordance with the current market information available.

Limitations of Wyckoff’s method

The Wyckoff theory is a useful framework for technical analysis but it also has certain limitations and problems when applied in practical trading.

- The recognition of the accumulation and distribution stage is not a simple task. It confuses most of the users of Wyckoff’s theory. The accumulation stage turns out to be distribution, vice versa, and the bottom may drop and the market does not behave as expected.

- It is also a very sophisticated task to time entries out of accumulation or distribution stages. It is not easy to buy or sell as there are no clear and obvious points to place stop-losses.

- Trading markups and markdowns aren’t easy either because it takes real expertise to trade price action patterns appearing in those stages. Moreover, the likelihood of trend reversal is more than the continuation.

- Wyckoff’s price cycle is a good theory but the price cycle doesn’t always follow the pattern described by Wyckoff. It can also behave in a random fashion.

Bottom line of the Wyckoff’s principles

Wyckoff’s method or Wyckoff’s theory is one of the most complete and valuable trading theory. Despite all the limitations of the Wyckoff’s method, no one can deny the fact the Wyckoff’s price cycle, Wyckoff’s laws, and overall rules are great concepts for analyzing and understanding the market and its behavior. However, it is always a prudent strategy in forex trading and technical analysis no to rely completely on a single framework. Technical analysts and experts always suggest combining Wyckoff’s method to other solid strategies such as market dynamics and price action. Although, the developments of the modern market is gradually limiting the usability of the Wyckoff’s method and Wyckoff’s price cycle, it still is a great framework for traders who know how to use it.

If you want to go even deeper into the Wyckoff’s theory, you may be very interested to check the related course on Udemy. Wyckoff Trading: Making Profits With Demand And Supply is rated 4.9/5 on Udemy and will finish to tour you around the Wyckoff’s method. Plus, there are pratical applications.

Click here to take the Wyckoff Trading course now!

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!