- The RSI (Relative Strength Index) indicator is a popular momentum oscillator.

- It provides traders with bullish and bearish price momentum signal.

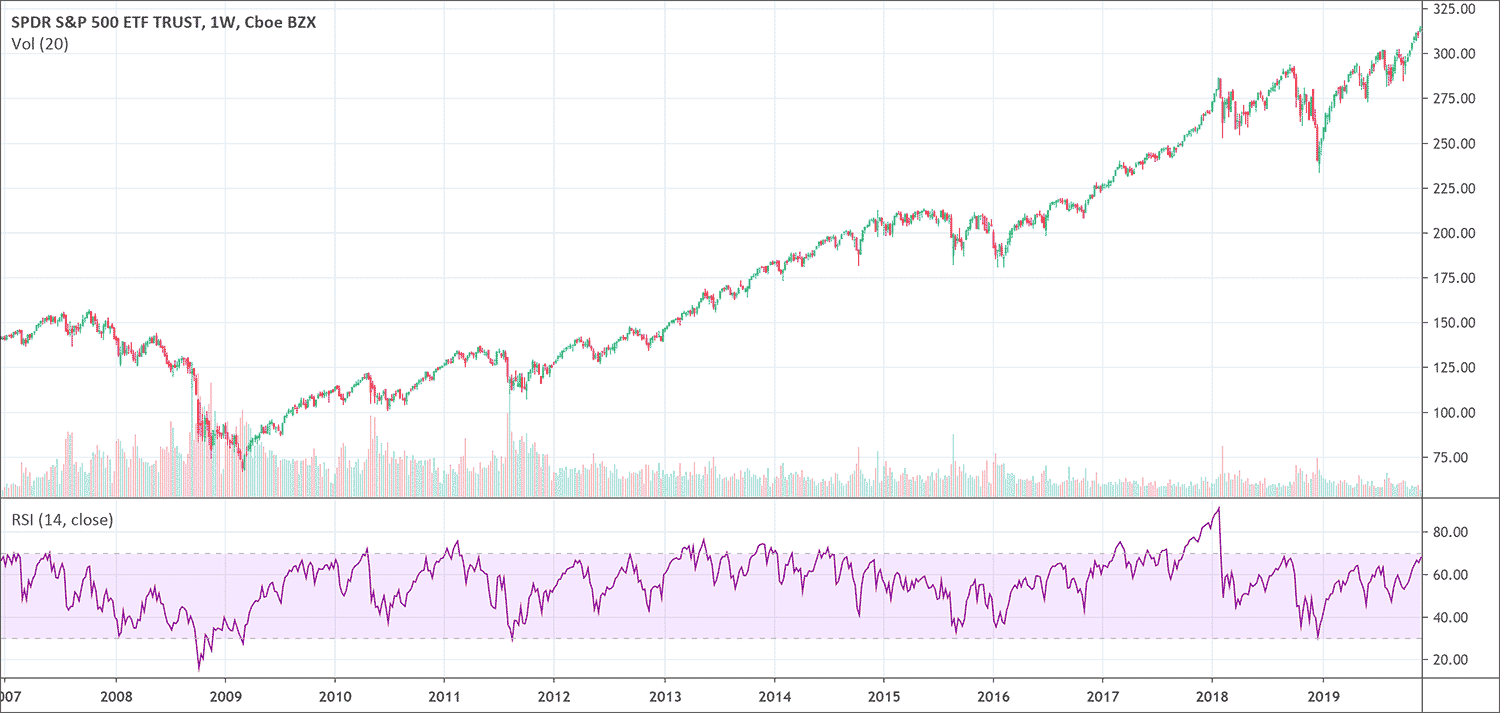

- When the RSI is above 70%, it’s considered overbought; when it’s below 30%, it’s considered oversold.

What is the Relative Strength Index indicator?

Relative strength index (RSI) is a popular indicator. The technical analyst named J. Welles Wilder developed this indicator and introduced it in his 1978 book, “New Concepts in Technical Trading Systems”. It aids traders to evaluate the strength of the current market. It is similar to Stochastic because it detects overbought and oversold situations in the market.

The RSI is a momentum indicator used in technical analysis that measures the number of recent price changes. It displays an oscillator (a line graph that moves between two ends) and can have a reading from 0 to 100.

Most traders see the RSI indicator is a leading indicator. It means that its signals come after a price event on the chart. The positive side of this is that early signals for trades can be attained. The downside is that many of these signals can be false or premature. Therefore, the RSI should always be used in combination with other trading techniques or tools for confirmation.

What does the Relative Strength Index indicator tell traders?

The major trend of the stock or asset is a vital tool in ensuring the readings of the indicator are properly understood. Traditional interpretation and application of the RSI indicator are that readings of 70 or higher mean that a security is becoming overbought or overvalued. It may be due for a trend reversal or corrective pullback in price. Some traders see an overbought currency pair as an indication that the rising trend is likely to reverse. This means it can be a good time to sell.

A relative strength index of 30 or below shows an oversold or undervalued situation. This is an increase in the probability of price going up. Traders interpret this as a sign that the falling trend will probably reverse, which means that it is an opportunity to buy.

In addition to the overbought and oversold conditions, traders who utilize the RSI indicator also look for middle crossovers. Movement from below the centerline (50) going higher shows a rising trend.

A rising centerline crossover comes up when the RSI value crosses above the 50 line on the scale, moving towards 70. This means the market trend is growing in strength and is seen as a bullish signal until the RSI gets to the 70 line.

A movement from above the centerline (50) going lower means a falling trend. A falling centerline crossover shows up when the RSI value crosses below the 50 line, going towards 30. This means the market trend is decreasing in strength. Traders see it as a bearish signal until the RSI gets to the 30 line.

RSI classic divergence

RSI bearish divergence comes up when the price makes a higher high, and at the same time, the RSI rise and makes a lower high. The RSI divergence usually forms at the top of the bullish market, and this is called a reversal pattern. Traders expect the reversal when the RSI Divergence forms. It is an advance reversal warning since it forms in several candles before the uptrend changes direction and breaks below its support line.

On the other hand, the RSI bullish divergence will appear when the price makes a lower low, and the RSI makes a higher low. This is an advance warning sign that the trend direction might go from a downtrend to an uptrend. RSI divergence is widely used in Forex technical analysis. Some traders prefer to use higher time-frames for trading RSI divergence. By using these strategies, traders get many RSI indicator to buy and sell signals.

How to use the Relative Strength Index indicator?

Trade entry with the Relative Strength Index indicator

To enter an RSI trade, you’ll need to see a signal from the RSI indicator. This could either be overbought or oversold RSI, or an RSI divergence pattern.

When entering an overbought/oversold signal, buy/sell the currency pair when the price action leaves the respective threshold on the RSI indicator.

As you trade divergence with the RSI indicator, enter a trade in the direction of the RSI, after the price action closes two or three candlesticks in a row in the direction of your intended trade.

Stop-loss

As discussed earlier, the RSI indicator can give false or premature signals if used alone, without further confirmation. Even when using it with other confirming studies, it is important to use a stop-loss to protect losses on your trade.

The highest place for your stop-loss order is beyond a recent swing top or bottom, which appears at the time of the reversal you are trading.

Take Profit

The basic rule of RSI states that you should hold your trade until getting an opposite signal from the RSI indicator. This could also be an overbought or oversold signal, as well as bearish or bullish RSI divergence. But in the practical sense, it makes sense to take your profits out early using other price action based rules or a stop-loss.

Biggest mistakes traders should avoid with the RSI indicator

When using the relative strength index, you should understand how an overbought or oversold condition impacts asset price. When a particular asset is overbought, it is anticipated that the asset is traded at a higher price above its fundamental price. While in a situation of oversold signals, it is anticipated that the asset is traded at a lesser price. You should know that RSI trading strategies mean the need for you to understand how you should act when some of the mentioned signals are identified. Primarily you will expect that reversal in trend direction can happen if there is an overbought or oversold signal.

Pros & cons of the RSI

Pros

- You can use the RSI indicator when defining short-term or long-term trading processes

- Helps traders to detect potential entry and exit points more accurately

- Can give an overview of the general price movement, reversals or trends

Cons

- There’s no certainty that as soon as the RSI line fell below the 30-line threshold or move over the 70-line, prices will instantly begin to increase or decrease

- The RSI can provide overbought or oversold signals for a long time when price has a lasting trend. This can result in false signals

- You should not use RSI as a standalone indicator

The RSI compares bullish and bearish price momentum. It shows the results in an oscillator. You can place it under a price chart. Like other technical indicators, its signals are most reliable when they conform to the long-term trend.

True reversal indicators are rare and can be hard to separate from false alarms. A false positive, for instance, would be a bullish crossover followed by a quick decrease in a stock. A false negative would be a condition where there is a bearish crossover, yet the stock suddenly accelerates upward.

Since the indicator shows momentum, it can remain overbought or oversold for a long period. It happens when an asset has important strength in either direction. Therefore, the RSI is most useful in an oscillating market where the asset price is changing between bearish and bullish movements.

Conclusion

It is very easy to trade using the RSI indicator. Beginner traders often start trading without testing different parameters, or educating themselves on the proper interpretation of an indicator, because of the desire to quickly grab money. Due to this, the RSI has become one of the most widely misused indicators.

Once understood and correctly used, the RSI has the ability to show whether prices are trending, when a market is overbought or oversold, and the best price to enter or leave a trade.

RSI can also show which trading time-frame is best. It offers information for knowing vital price levels of support and resistance. It can provide traders with technical trend information, as well as buy and sell signals.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!