- The Mat Hold candlestick pattern is a 5-candle pattern

- It can be bullish or bearish depending on its formation

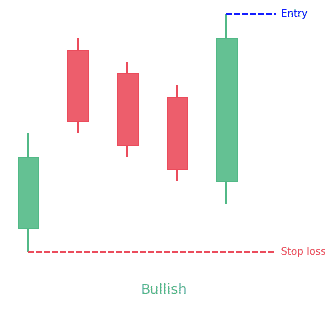

- For the bullish pattern, there is a tall green candle, 3 small red candles and the last candle is a tall green candle closing above the pattern

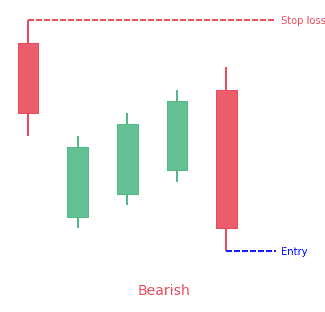

- For the bearish pattern, there is a tall red candle, 3 small green candles and the last candle is a tall red candle closing below the pattern

Statistics to prove if the Mat Hold pattern really works

Are the odds of the Mat Hold pattern in your favor?

How does the Mat Hold behave with a 2:1 target R/R ratio?

From our research the Mat Hold pattern confirms 82% of the time on average overall all the 4120 markets we analysed. Historically, this patterns confirmed within 7.3 candles or got invalidated within 24.4 candles. If confirmed, it reached the 2:1 R/R target 20% of the time and it retested it's entry price level 98% of the time.

Not accounting for fees, it has an expected outcome of -0.4 $/$.

It means for every $100 you risk on a trade with the Mat Hold pattern you lose $40 on average.

Want to account for your trading fees? Have the detailled stats for your favorite markets / timeframes? Or get the stats for another R/R than 2:1?

🚀 Join us now and get fine-tuned stats you care about!

How to handle risk with the Mat Hold pattern?

We analysed 4120 markets for the last 59 years and we found 61 occurrences of the Mat Hold pattern.

On average markets printed 1 Mat Hold pattern every 255 773 candles.

For 2:1 R/R trades, the longest winning streak observed was 2 and the longest losing streak was 7. A trading strategy relying solely on this pattern is not advised. Anyway, make sure to use proper risk management.

Keep in mind all these informations are for educational purposes only and are NOT financial advice.

If you want to learn more and deep dive into candlestick patterns performance statistics, I strongly recommend you follow the best available course about it. Joe Marwood (who's a famous trader with more than 45 000 Twitter followers) created an online course called "Candlestick Analysis For Professional Traders" in his Marwood Research University. There he will take you through the extensive backtesting of the 26 main candlestick patterns. He then summarizes which one is THE best pattern. Do you know which one it is?

Remember, don't trade if you don't know your stats. Click here to signup to the course now!

Candlestick patterns tell traders a unique story about the state of the market. It’s also the case for the mat hold candlestick pattern. And as traders, we are interested in knowing what goes on in the market, to have a clue about where it might be headed next. With their unique shapes, they tell different tales about what formed the market action.

Now, it might be impossible to understand why a market performed certain moves as it did. However, always analyzing market action is good practice for any trader. It’s a perfect way to better understand the market because you will begin to see recurring patterns that might eventually be turned into trading strategies.

What is the Mat Hold candlestick pattern?

Mat hold candlestick pattern is a pattern seen in the technical analysis of stocks or commodities that show the stock will continue its previous directional trend, whether bullish or bearish.

This type of pattern is initially shown by a profitable trading day in one direction or another, followed by three small opposite trending days. The fifth day then continues the trend of the first day, pushing lower or higher, in the same direction as the movement of the first day.

The pattern is seen as a very dependable but rare indicator in technical analysis. It is mostly confused with the rising-three indicator; with the difference being that the trades on days two to four of the rising-three indicator generally stay within the high and low formed on the first day.

Investors and analysts apply this pattern when trying to predict whether the current uptrend will continue, and to what extent. Traders and analysts generally assume this chart pattern means the momentum will hold steady and the upward trend will continue.

Bullish Mat Hold candlestick pattern

A bullish mat hold is a five-candle candlestick pattern that comes up in an ongoing uptrend and indicates that the trend will keep on being bullish. The first candle of the bullish mat hold is tall and positive and is followed by three small, negative candles. The last candle is large and bullish and closes on top of the high of the pattern.

In the bullish mat hold pattern, the first and last candles are large and bullish, while the three candles in between are small and bearish.

Characteristics of a Bullish Mat Hold Pattern

- The first candle is tall and positive and appears in a bullish trend

- The next three candles are bearish and close lower than the initial bar

- The last candle is large and bullish and manages to close over the high of the pattern

Bearish Mat Hold candlestick pattern

This is a five-candle bearish continuation pattern that appears in a bearish trend and indicates that the market is making a temporary pause, after which it is expected to continue going down. In a bearish mat hold, there are five candlesticks. The first and fifth are negative, while the three intervening candles are positive.

Characteristics of a Bearish Mat Hold

- The first candle is tall and bearish, and part of the bearish trend

- Second, third, and fourth candles are small and bullish

- Fifth, the last candle is large and bearish and closes less than the low of the pattern

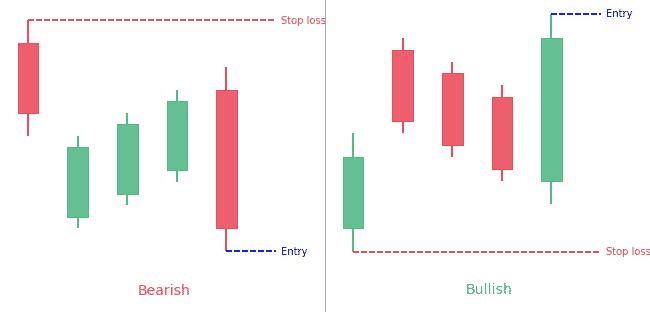

Inverted Mat Hold pattern

An inverted mat hold pattern is made up of five Japanese candlesticks. This is a variation of the three-method structure. The first is a big bearish candlestick (red), followed by three little bullish candlesticks (green). Each small candlestick has to close higher than the previous one. The opening of the second candlestick has to be on a bearish gap. Lastly, the final candlestick has to also open on a bearish gap and close below the lower point of the second candlestick. The pattern is also known as an inverted saucer pattern.

How to identify the Mat Hold candlestick pattern?

A mat hold structure is made up of five Japanese candlesticks. This is a variation of the three methods structure. The first is a big bullish candlestick (green), then three small bearish candlesticks (red). Each small candlestick has to close lower than the previous one. The opening of the second candlestick has to be on a bullish gap. Lastly, the final candlestick has to also open on a bullish gap and close above the high point of the second candlestick. The pattern is also known as a rising three-method pattern.

What does the Mat Hold pattern tell traders?

Bullish Mat Hold

As the current market trend is positive, a lot of investors and traders believe that prices are going to continue rising. As a result of this belief, the market forms the first positive candle of the bullish mat hold.

But after going up for some time, the market is becoming over-saturated, with many buyers trooping in. Similarly, more and more market participants start to worry that a correction may be close by, because of the strong developments of the last period.

Due to this, more traders try to get out of their position, which causes the flow of sell orders to hit the market. This makes the three bearish candles to form.

Now, despite the absence of a pullback, it didn’t get too serious. This brings new life to the bullish sentiment, which takes its chance to move the market higher, forming the last, bullish candle. The bullish mat hold is a story about an advancing market that performed a plain, ordinary pullback before it advanced to new heights.

Bearish Mat Hold

Since the market is now negative, most traders have a negative outlook and believe that there will be lower prices. As a result, selling pressure is high, and the market makes the first negative candle of the bearish mat hold. Now, having crashed for some time, the market is becoming oversold, which raises the possibility of a pullback.

As traders realize this, they stop giving out sell orders, hoping that a pullback will occur. This then gives way for the bullish market participants and their buy orders, which drive the market up for the coming three bars.

Even though the market has managed to make three positive candles, they were short and insignificant. This indicates that bears still are in control, and that bulls are weak.

As the market makes the last, bearish candle, it confirms that what we saw was nothing but a temporary pullback and that the market now is going lower.

How to trade when you see the Mat Hold candlestick pattern?

The implication of the mat hold candlestick pattern is that the trend has not been stopped. This is a good point to add to positions. The pattern is a stronger continuation pattern than the other methods. During the days of ‘rest,’ the price stays close to the top of the upper range of the white candle.

Criteria

- An uptrend is happening, which forms a long white candle

- A gap up day that closes lower than its open makes a small black candle

- The next two days make small candles

- The last day gaps-up and closes above the trading ranges of the previous four days

Pattern psychology

This candlestick pattern does not pull back as much as other trading methods, and it is easier to identify. The pull-back days are less concerning and the relatively flat rest period does not make the same amount of concern. There are three days in which the bears are not able to knock the price down to any great degree and as a results the bulls step back in with confidence.

The investment psychology made into candlestick signals makes it easier to understand what is happening in the mind of an investor. The signals were made through hundreds of years of visual analysis and interpretation by successful rice traders from Japan.

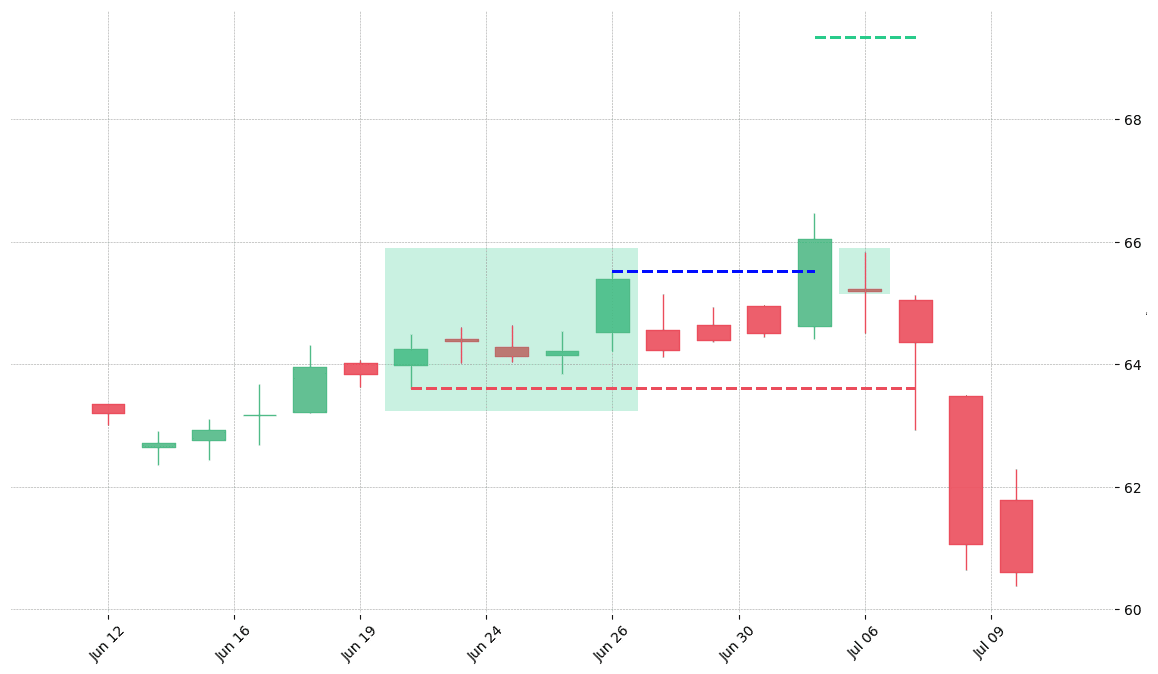

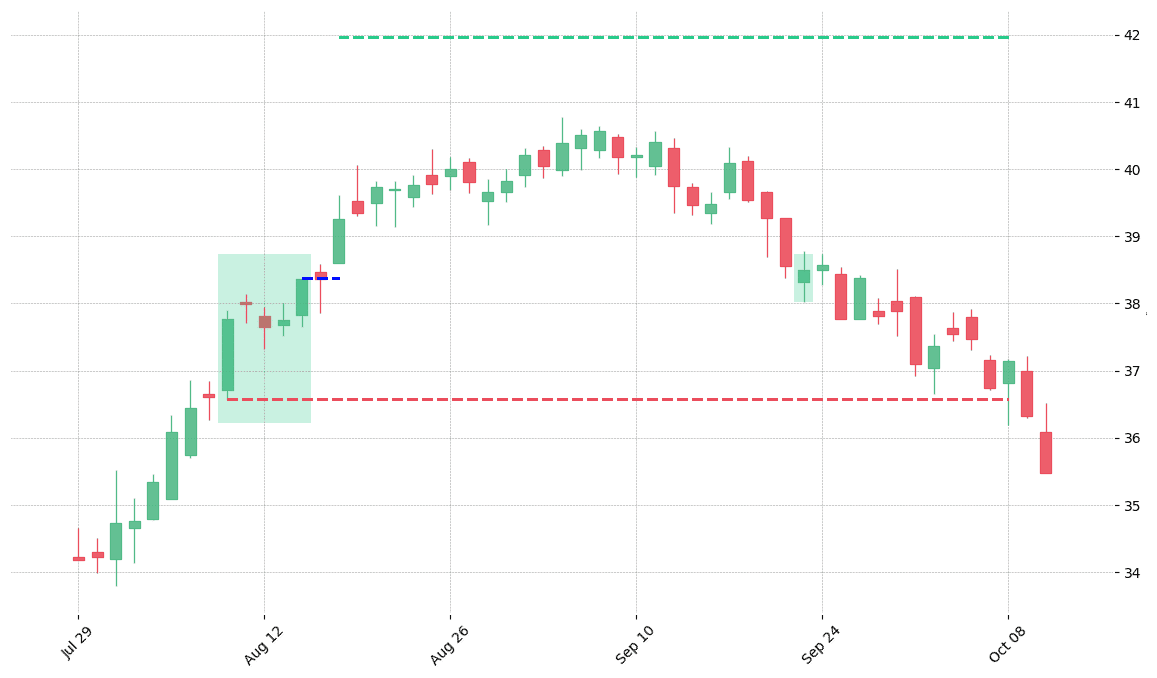

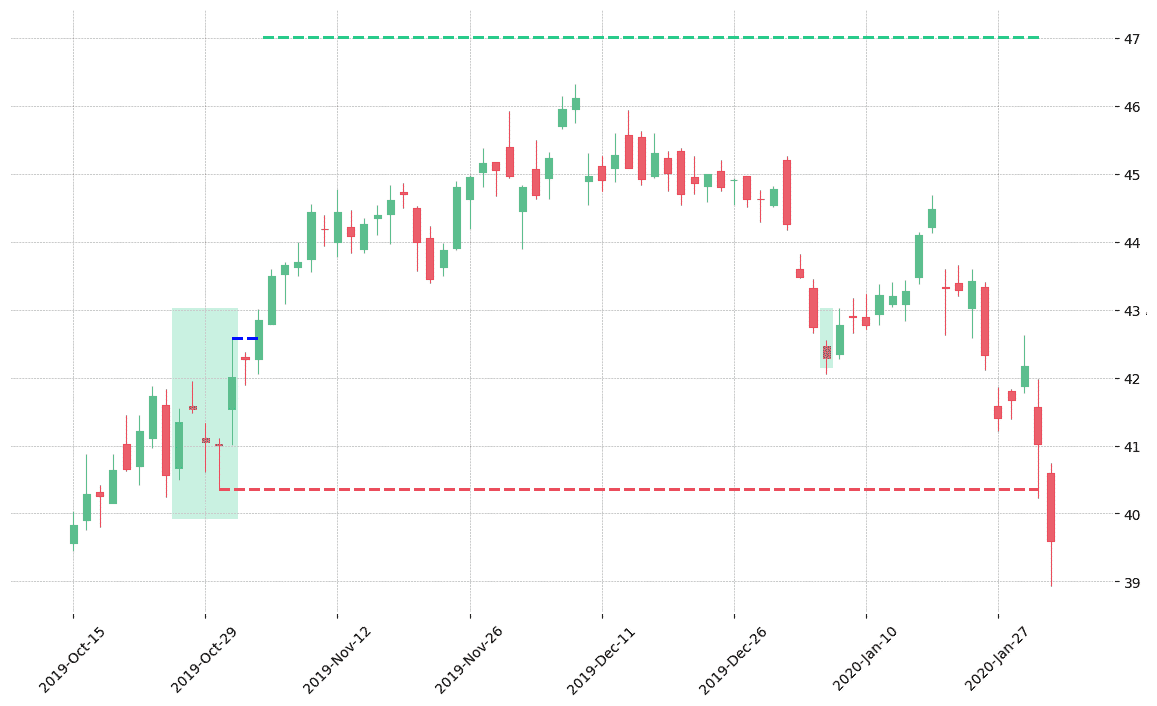

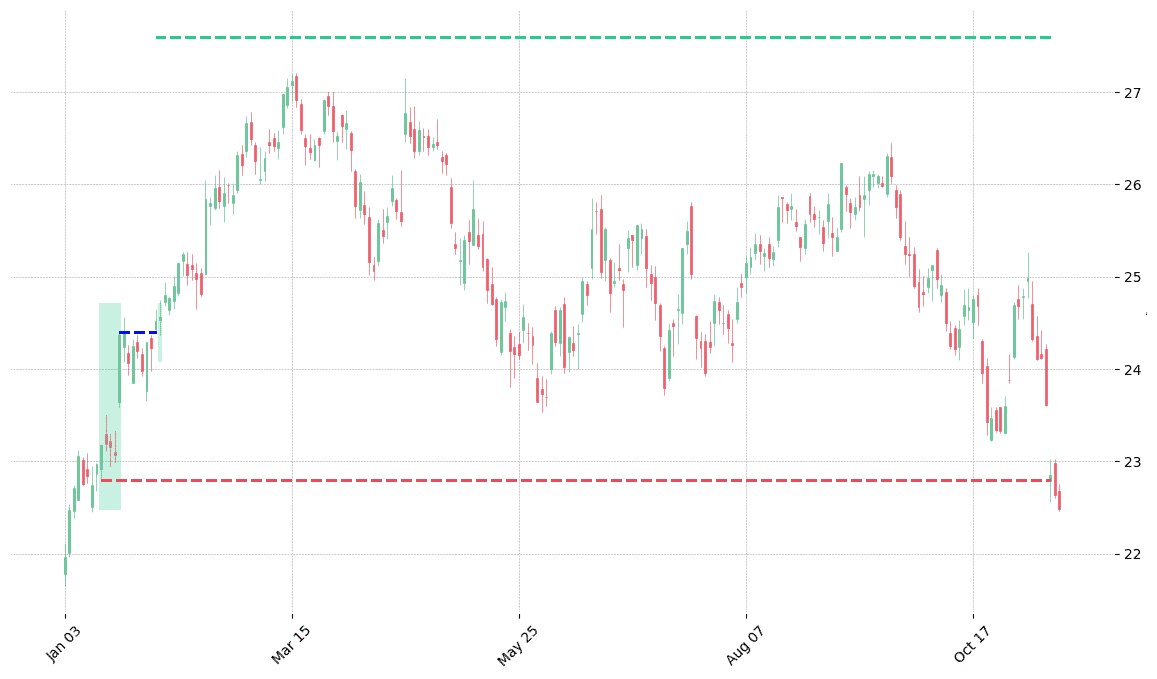

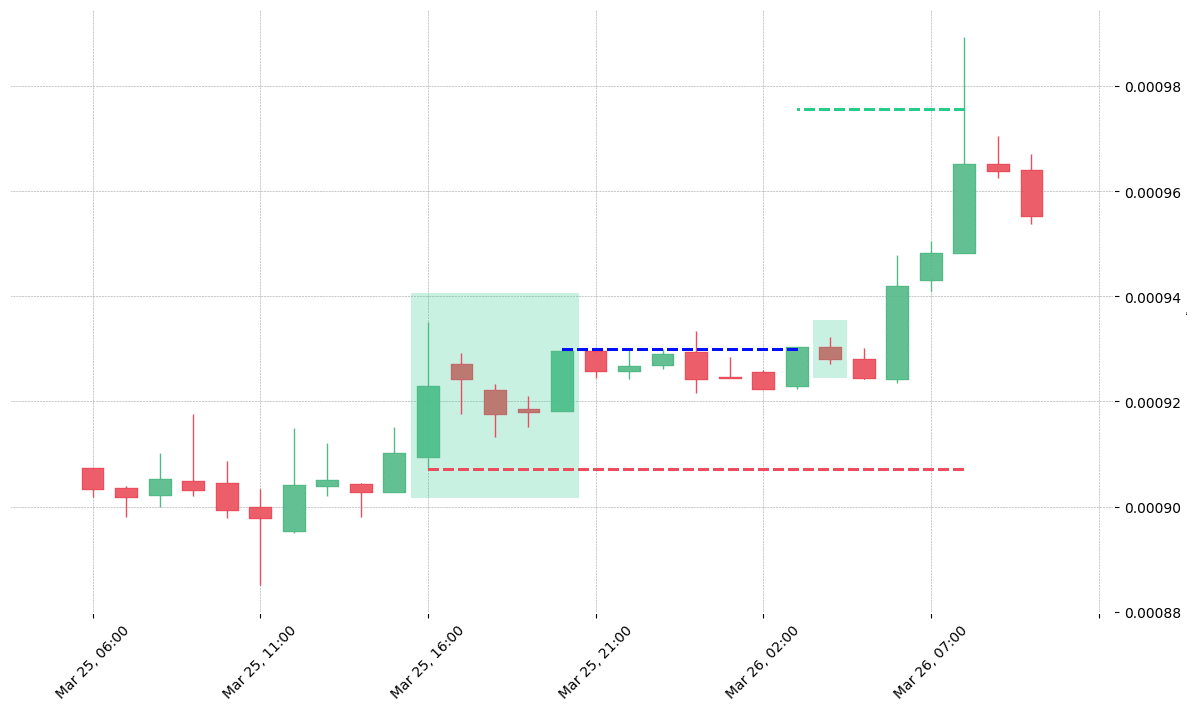

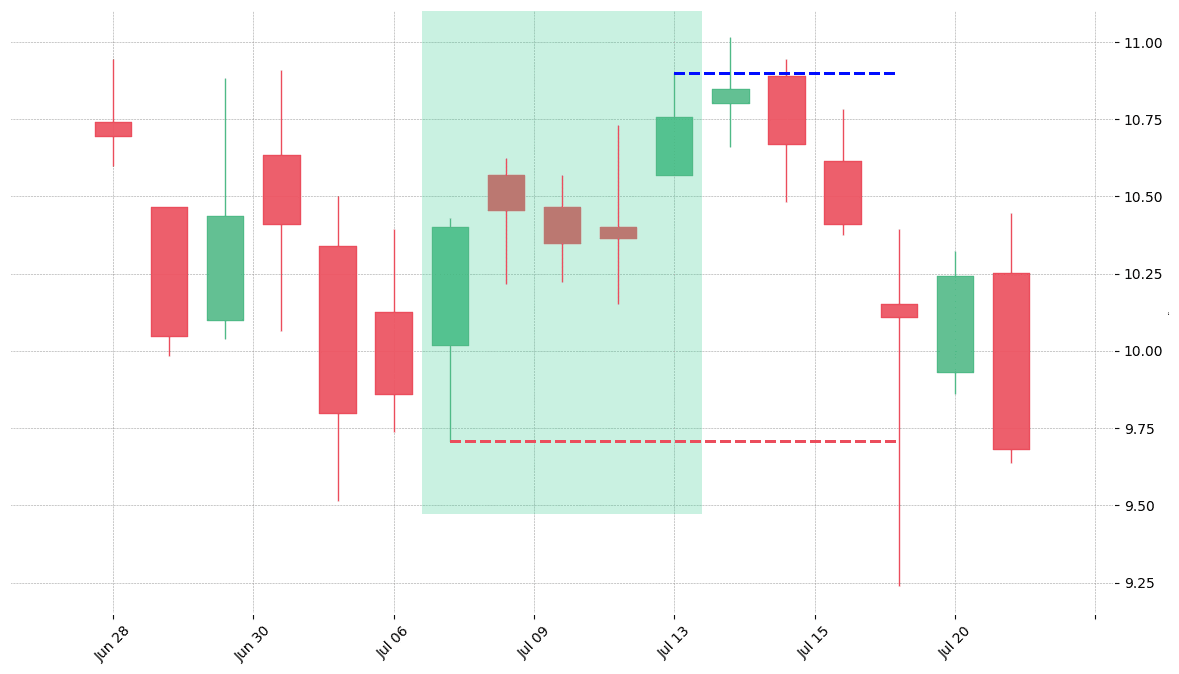

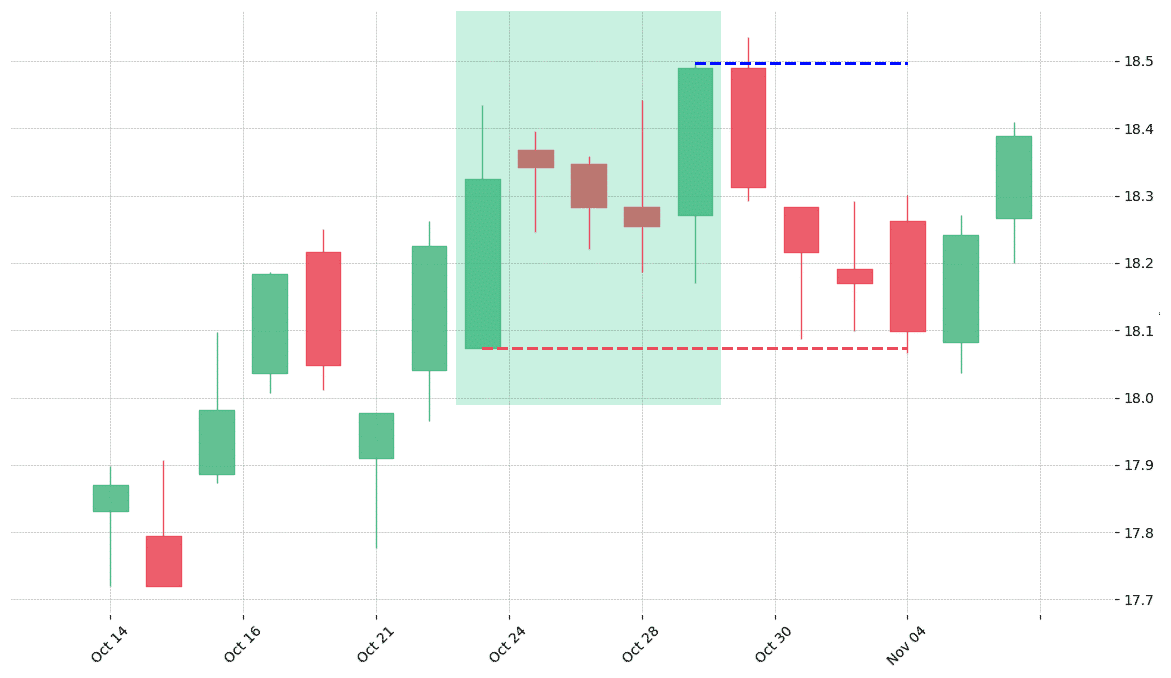

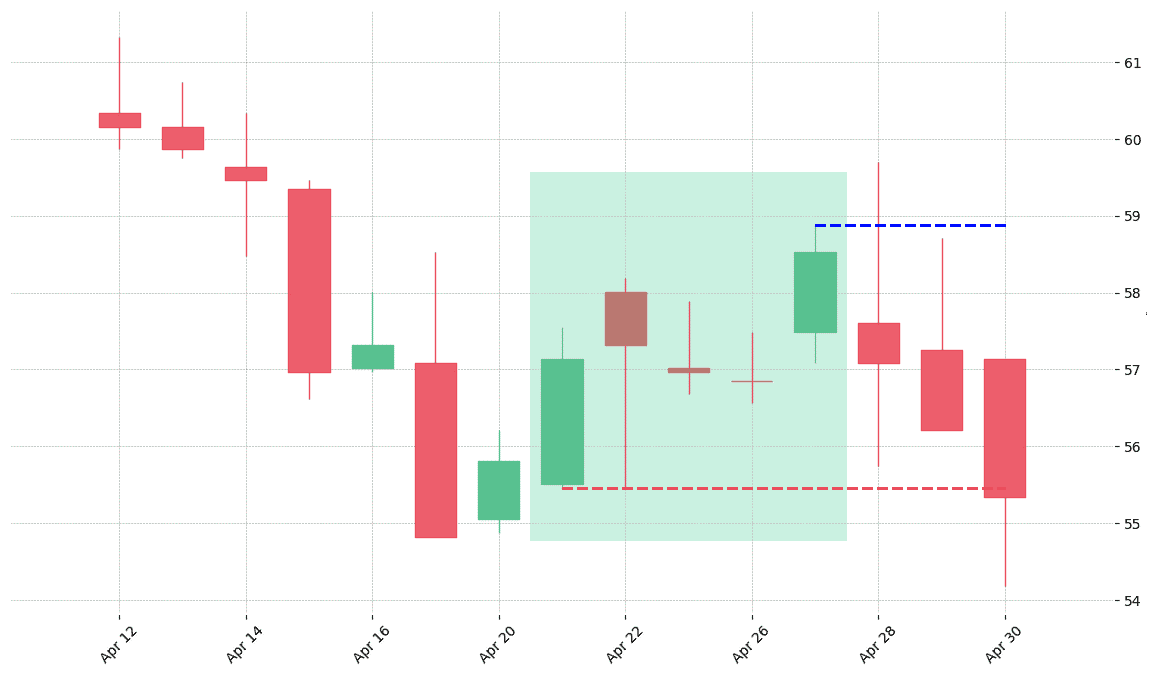

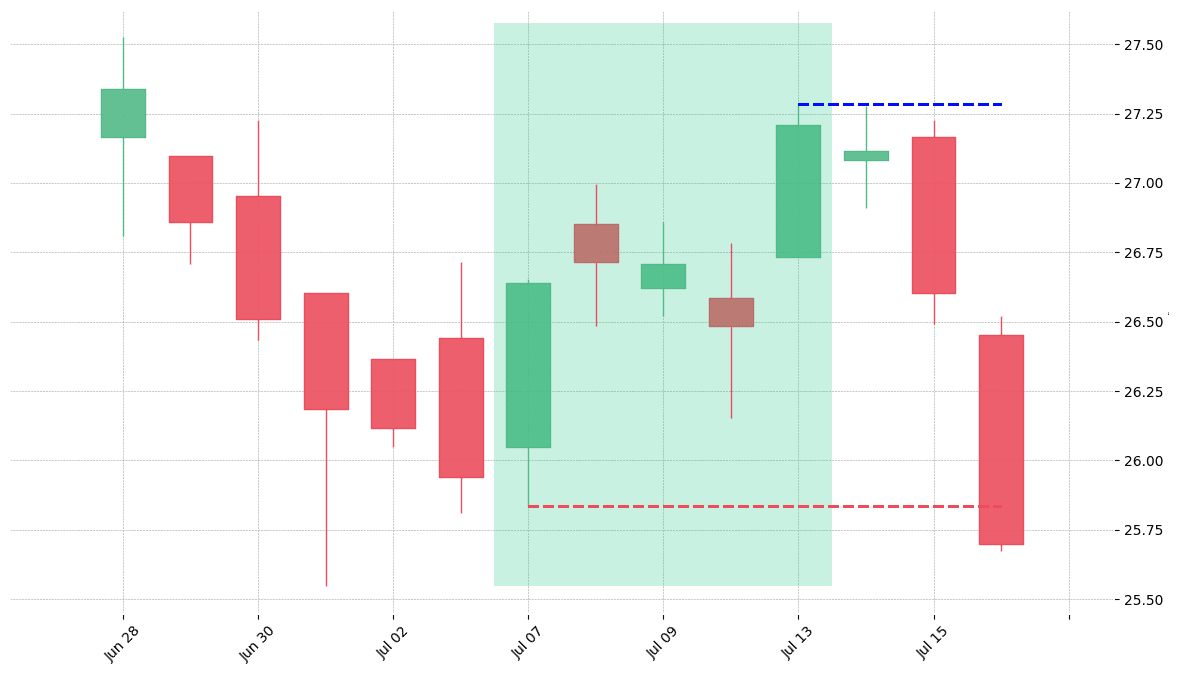

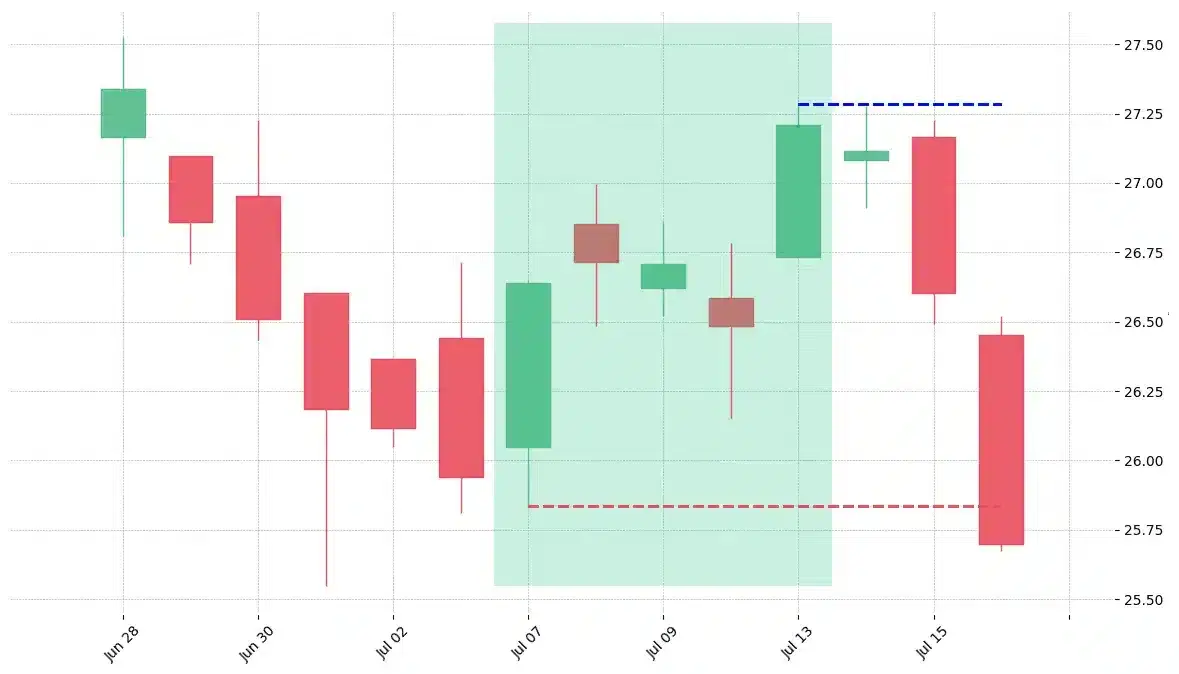

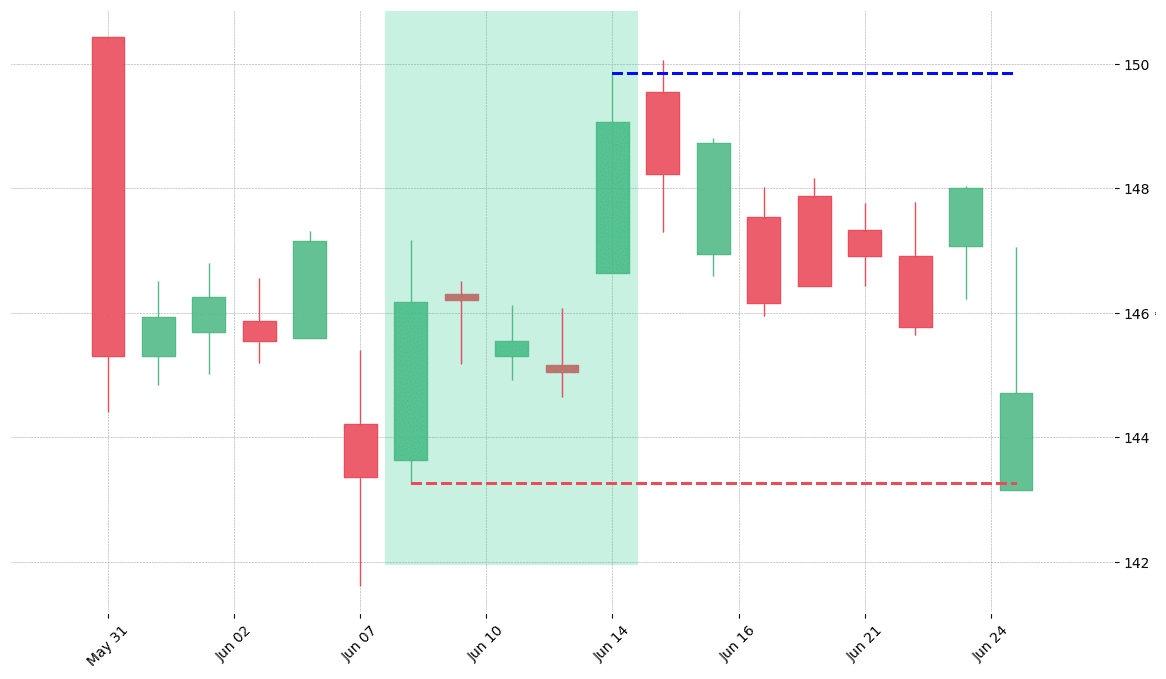

How does the Mat Hold pattern look in real life?

Looking to learn more about this pattern?

You should take a look at Joe Marwood's online course. In his course, he backtested the 26 main candlestick patterns before to summarize which one is THE best pattern. I really liked his course and you shouldn't miss it!

Click here to signup to his "Candlestick Analysis For Professional Traders" course now!

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!