- Implied volatility (IV) is a measure that helps traders to understand the chances of changes in the prices of a given security.

- In options, IV is the underlying instrument’s volatility.

Implied Volatility? What is it?

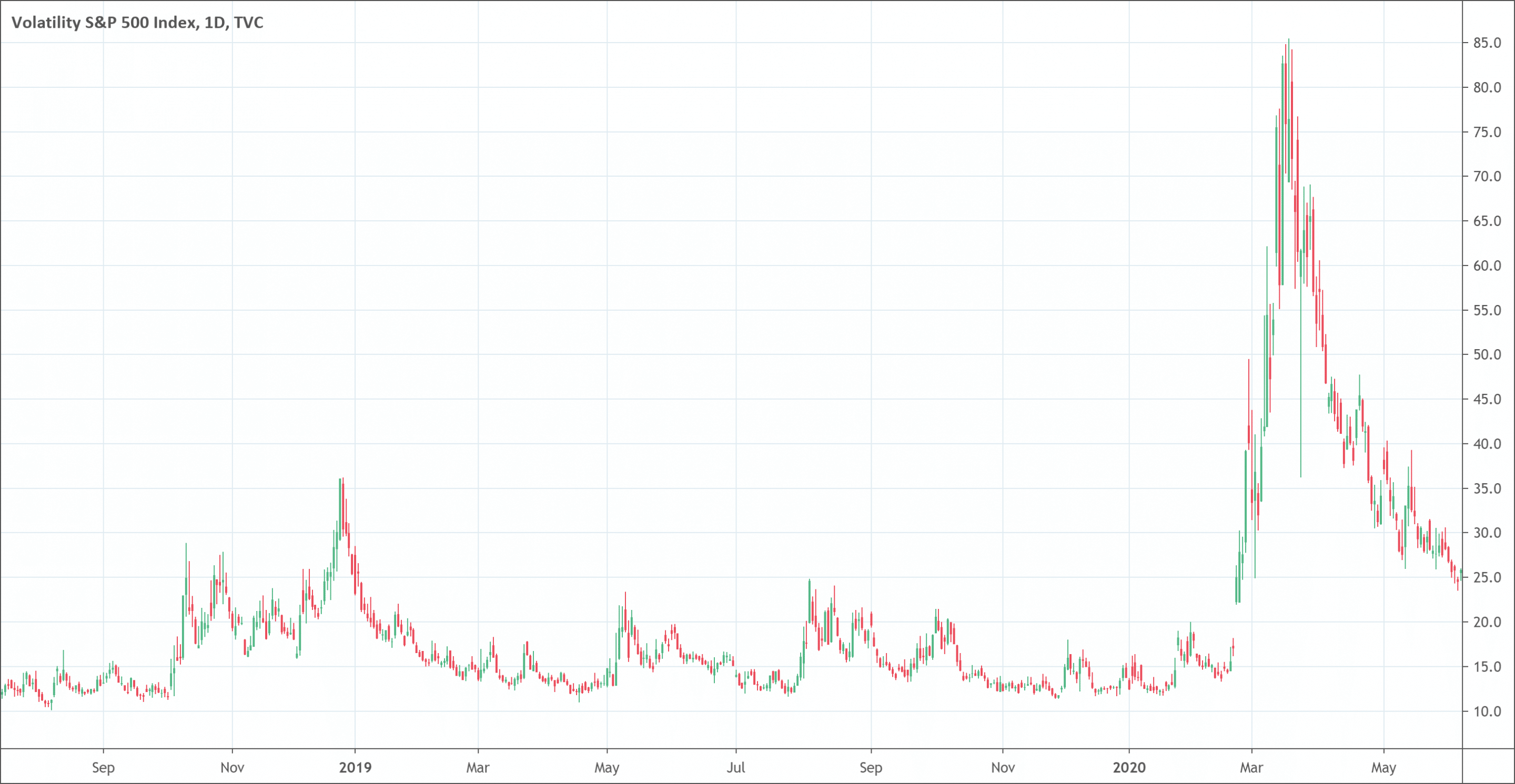

Implied volatility (IV) is a measure that helps traders to understand the chances of changes in the prices of a given security. IV is a kind of forecast that predicts an upcoming movement in a security’s price, especially options. Implied volatility in options is the underlying instrument’s volatility, when used as an input value in any one of the option pricing models such as Black-Scholes, gives a theoretical value equal to the current market price of that particular option. Non-option financial instruments with embedded optionality also have implied volatility. IV is a subjective as well as a forward-looking measure that is one of the most important concepts in the modern techniques of technical analysis in financial trading.

Options are wonderful financial instruments that allow investors to enter financial markets even if they don’t have an extravagant amount to begin trade. But investors don’t usually get involved with options because of complexities. However, when investors understand options with the lens of IV, the complexities begin to wane. The reason is, IV measures give an insight into the pricing and working of the options. It is a handy measure that allows investors to get a good value on their options. Higher volatility in options is a positive thing. The bigger movement of the implied volatility in options in the right direction gives greater profits to the investors.

The historical volatility in the options is another important concept. However, IV differs from historical volatility. The former is a forecast that has significance in the future because it is an estimate of future price movements. The latter’s calculations base on the past returns of the financial instruments. Implied volatility is more important and useful for options traders than the historical volatility because IV has a say in all the market expectations.

What does the implied volatility tell traders?

Implied volatility is a very crucial concept for option traders because it tells traders about possible entry/exit points, market expectations, devising an overall strategy, and also increases the odds of maximizing profits. It indicates how volatile the market will be in the future. It also helps to calculate the probability. The probability is a very important factor to predict the likelihood of stock to reach a specific point in the future. However, it is important to note that the implied volatility is a theoretical data and hence, cannot guarantee that the forecast will be 100% correct.

How to find and use implied volatility?

Implied volatility is a measure of future fluctuations in the market. The IV ratio is expressed in terms of percentage. Some option brokerages and some financial news websites give the volatility ratio. Dividing an option’s implied volatility with the historical volatility gives the implied volatility ratio. A ratio of 1 is generally considered a fair price. That means, the option will be overpriced if it has a ratio above 1 such as 1.2 ratio suggests the option is overpriced by 20%. On the other hand, an option will be under-priced if the option’s volatility ratio is less than 1 such as .70 ratio suggests the option is underpriced by 30%.

The implied volatility can help in several different ways to evaluate a fair asking price of an option. The Black-Scholes model is the most widely used and important model in this regard. Data such as expiration date, historical volatility, interest rates, and the price is useful for calculations of the Black-Scholes model. Investors evaluate the Black-Scholes price by dividing it with the option’s current asking price. According to the implied volatility ratio, an option with a value higher than 1 is overpriced.

How options traders can use implied volatility in trading?

Implied volatility is an important measure because it allows options traders to make more informed decisions.

Entry and exit point

The implied volatility of options is lower and traders have a positive outlook on the specific underlying, it is a good entry point to buy options. The premium is also usually low at this level. Hence, if traders are seeking an entry point for options trade, they should look at the options’ implied volatility. The lower implied volatility in options means lower prices of the options. Thus, option buying is available at low prices. On the other hand, if the options’ implied volatility is higher, traders should deal according to their own trading strategy rather than going for extensive buying.

Market expectations

The implied volatility has a say in all market expectations. Therefore, it gives a good insight into the overall psychology of the traders. For example, if an option has implied volatility in the range of 18%-20% and the IV goes beyond the higher or lower threshold, traders can expect an upcoming change in trend (given the market conditions are normal).

Increase profits

The direct relationship between the premium of options and implied volatility is extremely important in the implied volatility concept. It allows traders to analyze whether they are on the right side of the volatility, therefore helps to maximize profits by trading on the right side.

Overall strategy

The implied volatility in options is a wonderful measure to make an overall trading strategy. The increase or decrease in volatility directly influences the performance of the strategy as well. The increase in the option’s implied volatility is good for strategies like long strangles/straddles, back spreads, etc. On the other hand, strategies like short-options and ratio spread perform well when the implied volatility is low.

The limitations of the implied volatility

As we have discussed earlier that the implied volatility is helpful to measure the market sentiment and the size of a stock’s movement. However, it doesn’t indicate the direction of the movement. The implied volatility solely relies on the prices and doesn’t consider fundamentals. It is also vulnerable to unexpected factors and news events. All those limitations make the implied volatility a little riskier to use in financial trading.

Conclusion

Among option traders, the implied volatility is one of the most important variables to determine the profits in options trading. The implied volatility is a crucial concept for traders and investors because they can easily determine whether they are on the right side of the volatility or not. The IV also indicates the future underlying stock volatility, even though it cannot predict the direction of the price movement. It forecasts the potential of the stock for fluctuations in the future. The option’s implied volatility measures assist traders to estimate the high or low swing of the stock. This estimate helps traders to enter or exit the trade by making informed decisions. However, implied volatility has also certain limitations that traders must account for before relying on it.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!