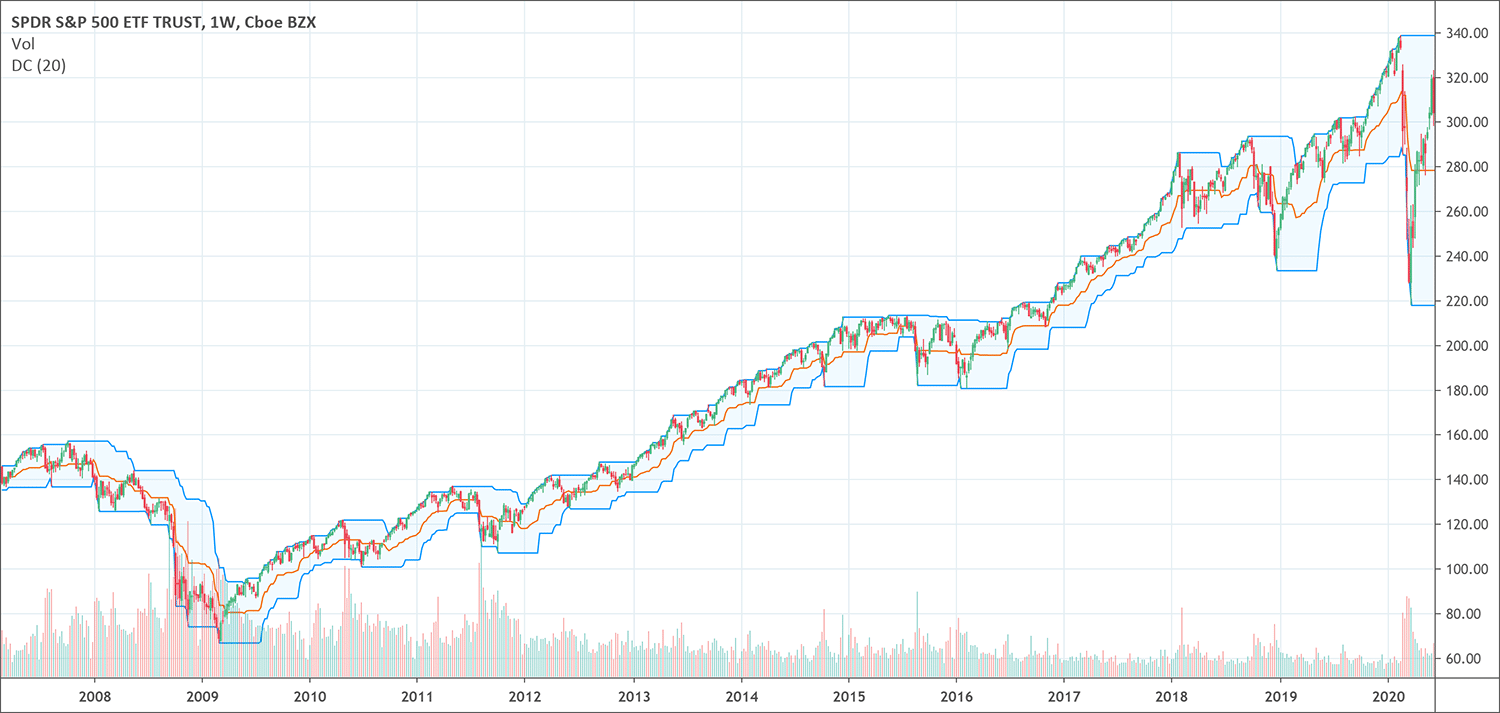

The Donchian Channel indicator is an intraday trend following indicator that allows you to identify trends. As we all know that trade breakouts is a popular trend following strategy. Breakouts can be conveniently measured through the lowest low and highest high. It functions to plot three types of bands. The first band is an upper band that is the n-bar high. The second is the lower band that is n-bar low and the average of the previous two bands make the middle band.

- The Donchian Channel is a volatility indicator.

- It seeks to identify price extremes which could lead to reversals (highest high and lowest low over N periods).

- The middle band simply computes the average this highest high and lowest low.

What is the Donchian Channel?

The Donchian Channel indicator is a technical analysis tool that plots those lowest lows and the highest highs on the chart. It calculates those prices by using by default 20 bars of data. However, traders can use shorter or longer Donchian Channels according to their own preference or trading strategy. “The 4-week rule” is also another name for the Donchian Channel because of default length of four trading weeks.

Almost all trend-following strategies work on a simple concept. When the lowest low or highest high line breaks, the market changes its opinion. In other words, perceived value shifts significantly. This change in market opinion sets the stage for the continuation of the breakout. This is exactly the same underlying idea of the Donchian Channel indicator as well. The breakout above the highest high line or below the lowest low line is considered a signal that demands some activity.

All trending instruments such as futures, cryptocurrencies, etc. work well with the Donchian Channel indicator. It can also efficiently work on almost all timeframes ranging from, let us say, one minute to months. These are the reasons that the Donchian Channel indicator is one of the most versatile indicators currently available to the traders. Richard Donchian, a famous commodities trader, developed this indicator in 1936. He is among the pioneers of mechanical trading and was a brilliant master of trend following.

How are the Donchian Channels calculated and what is the formula?

The calculations of the Donchian Channel indicator are based on a very simple but effective way. As we have already discussed that its functioning is based on three bands that are plotted on the chart. Two of them are the lowest low and the highest high while the middle band is sandwiched between the two outer bands. The Donchian Channel indicator uses the following formula:

Lower band or lower channel (LC) = The lowest low for the last n-periods

Middle band or middle channel (MD) = The average of the lower and upper band for the last n-periods (UC – LC / 2)

Upper band or upper channel (UC) = The highest high for the last n-periods

While the n is the number of periods that you decide. Most of the traders prefer the default 20 period setting, although you may choose any timeframe ranging from minutes to hours or weeks. It must be remembered that the best setting vary significantly depending on the chosen timeframe and the market of your trade.

What does the Donchian Channel indicator tell traders?

As the calculation method or formula of the Donchian Channel indicator suggests that the Donchian Channel revolves around establishing a relationship between current price and trading ranges over a chosen timeframe. Three values that are calculated build a visual map on the charts that illustrates prices over the predetermined periods.

It makes it easy for the traders to identify bullish and bearish trends over that period of time.

The highest high or upper band indicates the success of bullish trend. Similarly, the lowest low or lower band shows the extent of bearish energy that brought the price to the lowest price. The middle band is the middle ground of the battle between bulls and bears and it shows the average or median that remained over the course of chose timeframe.

Traders can also use the Donchian Channel indicator to measure the volatility of the market along with identifying breakouts or overbought/oversold conditions.

How to use the Donchian Channel indicator?

The Donchian Channel indicator works purely on following the prices and does not try to guess about support and resistance areas. It is the great strength of the Donchian Channel indicator. Its trend-following trait guarantees that the traders will remain on the right track.

It generates two signals. The first one is when the prices cross the highest high or the upper band. The second is when the prices cross the lowest low or the lower band. Technical analysts advise to enter a long position when the Donchian Channel indicator generates the upper band crossing signal and sell when the lower band is crossed. Upon the lower band crossing, it is a wise move to initiate a short trade.

It is interesting that during an uptrend, the upper band is pushed higher with the arrival of new highs. Similarly, new highs have also higher lows making the lower band also move higher. This is the reason that long exits are fruitful for the traders during the longer trends. However, it is absolutely imperative to be sure about the existence of a trend.

The traders can also use it to measure the volatility of the market for their particular trading strategy. The difference between the upper and lower band for the predetermined period is the volatility level in the market.

The pros and cons of the Donchian Channel indicator

The trading markets are always risky forums to do business. Although a lot of trading tools have been developed over the years, the levels of risk have not been curtailed. All the technical analysis tools come with their particular advantages as well as the disadvantages that must be accounted for before opting to employ a trading tool. The Donchian Channel indicator has also certain pros and cons that are worth taking into consideration.

Pros of the Donchian Channel indicator

- It is a trend-follower indicator and relies on actual data, therefore, it is one of the most reliable indicators

- Being a trend-following indicator, it can help to capitalize on the momentum of the market by following the trend.

- It is easy to know the volume of the market by calculating the difference between the upper and lower band of the past n-periods.

- It is versatile indicator and works well with all timeframes such as hours, days, weeks, etc. and can be used in different trading markets like futures, options, stocks, forex, cryptocurrencies, etc.

Cons of the Donchian Channel indicator

- It is not always easy to trade. It may generate false signals when prices move sideways.

- When the trends do not go long enough, the traders cannot exit the market profitably because there is not always enough price movement to jump out of the market with profit

Conclusion

The Donchian Channel indicator measures volatility to determine the overbought or oversold market conditions. It is worth noticing that it works well with a clearly defined trend.

The movements into the overbought zone and oversold zone indicate the strengthening trend during a bullish and bearish trend respectively. This indication is significantly strong especially when those movements happen frequently during the trend. In order to get maximum advantages, it is important to be sure about the overall trend.

It is also important to make sure to validate your trading strategy before taking any action. The reason is that you cannot be absolutely sure about the reaction of your trading market and timeframes. However, it is really a great advantage of the Donchian Channel indicator that it can work well with other indicators such as the Directional movement. This combination of the Donchian Channel indicator with any other indicator increases the odds of maximizing the gains.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!