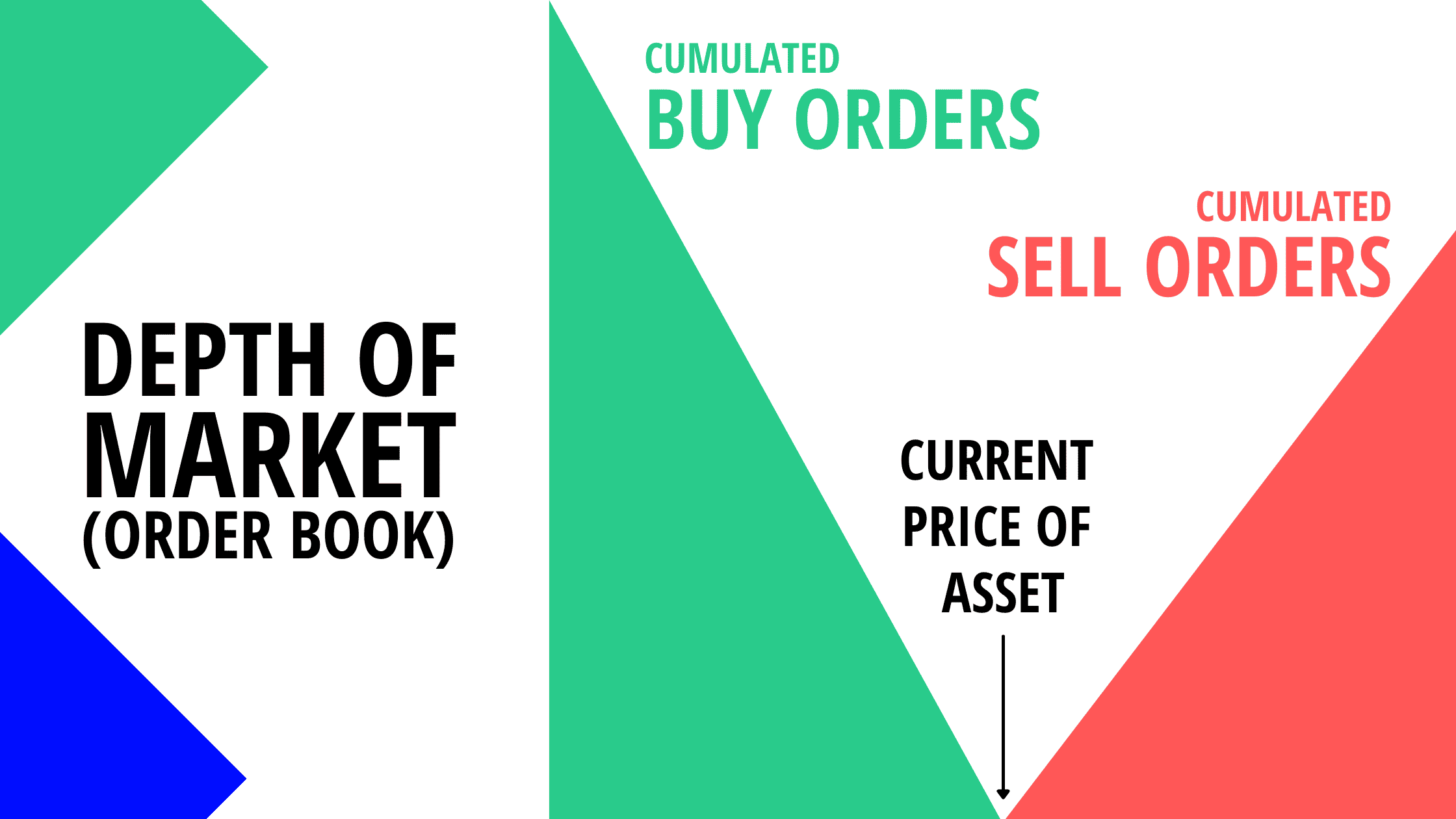

Depth of Market (DOM) is an electronic list of pending orders for a particular stock or any other financial instrument. In the simplest terms, DOM is a visual display of open buying and selling orders, organized by price level, for a specific instrument.

- Depth of Market or DOM is an electronic list that enables you to visualize pending orders of a particular stock or security.

- It is a kind of indicator that indicates the interest of the traders or investors in a particular instrument.

- DOM data helps traders and investors determine the optimal time for buying or selling in the market.

Depth of Market is also known as the Order Book. Market depth indicates the number of orders being offered or bid on at each price point.

DOM also reflects the market liquidity. A market is deeper and more liquid if the quantity of orders in a queue is high. Conversely, a market is shallow or less liquid if the quantity of pending orders is low. Depth of Market data is extremely crucial in trading and investing activities. Moreover, DOM data is also easy to acquire because most of the online brokers provide order books for free or for a very negligible price.

How does Depth of Market work?

Almost all online brokers provide the order book for various instruments such as stocks, currencies, cryptocurrencies, etc. Typically, there are four main components of an order book.

- Buy orders – show all the information about buyers and their bids to purchase a particular asset.

- Sell orders – display all the information about sellers and their offers to sell a particular asset.

- Price – each price level gives the total number of orders (number of participants willing to buy or sell).

- Size – highlights the liquidity size for both sides of the market (buying and selling).

DOM data is regularly updated throughout the day. That means an order book is dynamic and reflects the intentions of market participants in real-time. Therefore, the Depth of the Market can be a key for traders and investors to make informed decisions. They can analyze market liquidity and also find imbalances in the market. Both of these indicators may provide clues about the price direction of instruments.

Use of the Depth of Market data

DOM data is very crucial for traders and investors to make informed decisions. First of all, they can analyze the data and find out where the price of a particular asset might be heading. Traders quickly determine by looking at the order book if there are more buying orders or more selling orders. Price is more likely to decrease when there are more sell orders in the market. Conversely, price tends to increase when there is more buying pressure.

Traders can also use market depth to determine the size of their orders. They can quickly assess if there is a required level of market depth and volume. If there is the right level of market depth and volume, it suits their trading style and they can take full advantage. How do they get to know? Because prices of assets with strong market depth don’t fluctuate much even when bulk orders are placed. The reason is that liquid assets have a huge number of buyers and sellers. On the contrary, orders trigger significant price movements of assets with shallow market depth. The reason is that there are not many buyers or sellers in the market. Therefore, buying or selling orders of shallow assets immediately causes price movements. Thus, DOM data helps traders determine the size of their orders.

Market depth also helps traders to make the most of the short-term price volatility. They can make huge profits by trading such assets. For example, when a newly listed company offers its stock, traders can view the market depth in real-time.

They can easily realize that there would be a huge buying and selling activity in the future. Thus, short-term traders make significant profits by buying or selling such assets when the prices reach their desired levels.

Final thoughts

Depth of Market or DOM is an electronic list that enables you to visualize pending orders of a particular stock or security. It is a kind of indicator that indicates the interest of the traders or investors in a particular instrument. DOM data helps traders and investors determine the optimal time for buying or selling in the market. Moreover, traders can also use the market depth data from an order book to determine the order size and take full advantage of the short-term price volatility. Thus, Depth of Market can help traders maximize their odds of success in trading.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!