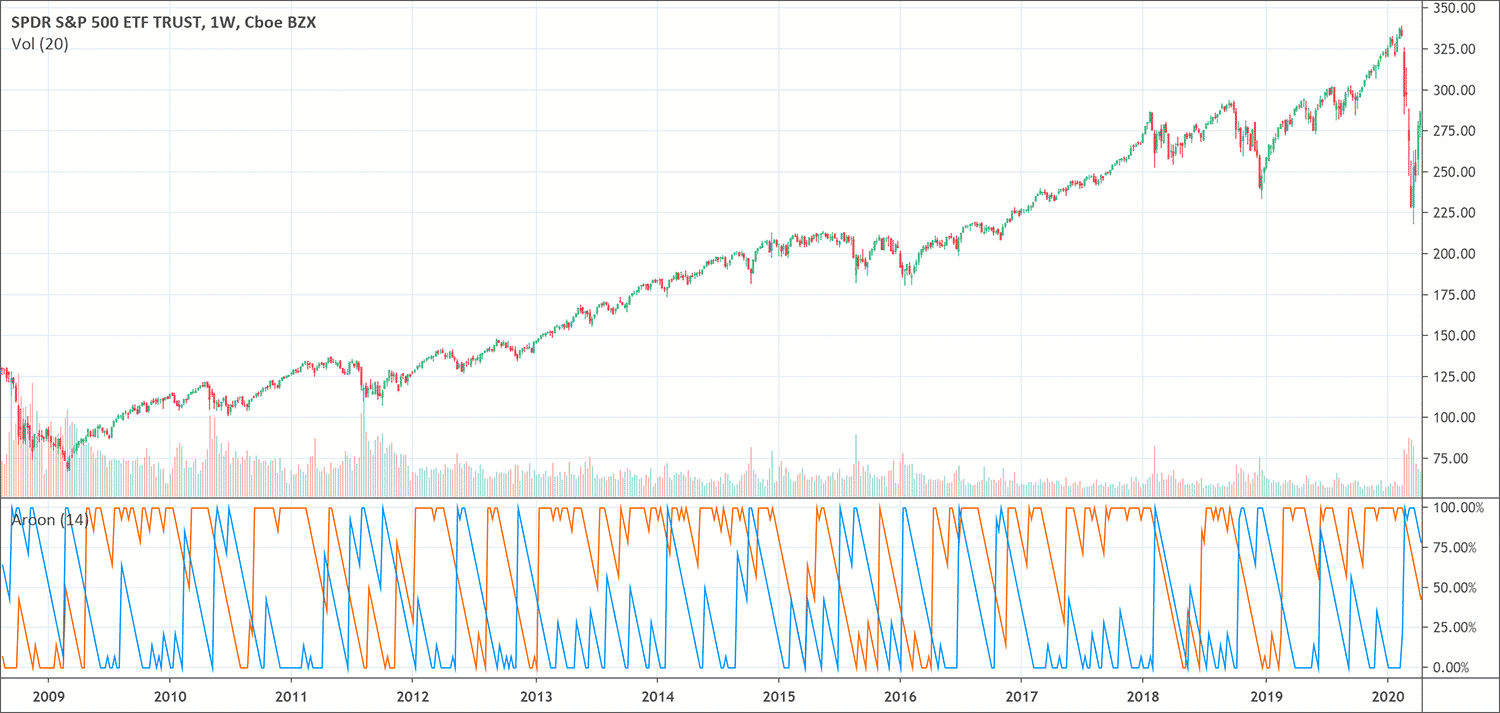

- The Aroon indicator is composed of two line:

- An up line which measures how far is the previous high

- A down line wich measures how far is the previous low

- When AroonUp is above AroonDown, it gives a bullish biais.

- When AroonUp is below AroonDown, it gives a bearish biais.

What is the Aroon indicator?

The Aroon indicator is a technical indicator. It is used to detect trend changes in the price of an asset, and the strength of that trend. The indicator measures the time between highs and the time between lows over a specific period.

The idea is that strong uptrends will regularly experience new highs, and strong downtrends will regularly experience new lows. The indicator indicates when this is happening, and when it isn’t.

Tushar Chande created the Aroon indicator in 1995. It shows if a price is trending or is in a trading range. It can also indicate the start of a new trend, its strength, and can help anticipate changes from trading ranges to trends.

The Aroon indicator is a two part indicator. There are:

- the “Aroon up” line, which measures the strength of the uptrend,

- and the “Aroon down” line, which measures the strength of the downtrend.

Aroon up

It measures how long it has been since prices have reached a new high within the particular period. If the current high of the bar is the highest within the user defined number of times before it, then the Aroon up value is 100. In other words, it is a new high for that time. Otherwise, it returns a percent value showing the time since a new high occurred for the particular period.

Aroon down

It measures how long it has been since prices have reached a new low within the particular time. If the current low of the bar is the lowest within the user defined number of times before it, then the Aroon down value is 100. In other words, it is a new low for the time. Otherwise it returns a percent value showing the time since the new low occurred for the particular time.

When it comes to day trading, ideas based on this indicator are some of the best you can apply to make quick profits. Aroon is one of the few technical indicators that can help traders achieve consistent success with trend trading, as well as trading within a range.

If you have been day trading for a long time, you have probably seen that the price of a stock or security mostly remains within a range, where the price moves impulsively. The price trends up or down only a small percentage of the time during trading hours.

The formula of the Aroon indicator was developed in a way that it can anticipate when the price action of a security is changing from a range-bound state to a trending state so that traders can establish short or long positions. It can also show when the price action of a security will probably stop trending and begin consolidating.

What does the Aroon indicator tell traders?

The Aroon up and the Aroon down lines always fluctuate between 0 and 100, with values close to 100 signifying a strong trend and values close to 0 meaning a weak trend. The lower the Aroon up, the weaker the uptrend will be, and the stronger the downtrend, and vice versa. The major assumption with this indicator is that the price of a stock will regularly close at new highs during an uptrend, and regularly make new lows in a downtrend.

The indicator focuses on the last 25 periods, but is scaled to 0 and 100. Therefore, its reading above 50 means the price made a new high within the last 12.5 periods. A reading close to 100 means a high recently happened.

The same concepts apply to the Aroon down. When it is more than 50, a low was seen within the 12.5 periods. A down reading close to 100 signifies a low was recently seen.

Crossovers can indicate entry or exit points. Up crossing more than down can be an indication to buy. Down crossing less than up may be an indication to sell.

When both indicators are less than 50, it means that the price is consolidating. New lows or highs are not being made. Traders can watch for breakouts as well as the next Aroon crossover to show which direction price is going.

How to use the Aroon indicator?

Traders can use the crossover of the Aroon up and Aroon down lines to easily know the directional movement of price. When the Aroon up crosses above the Aroon down, it creates a signal that the price is about to begin a potential bullish move. On the other hand, when the Aroon down crosses below the Aroon up line, it shows a potential bearish move.

But you should not place a sell or buy order whenever there is a new crossover, because this is shows that the existing trend has changed. Rather, you should wait for the price of the security to breakout of a range or trend line before opening a new position in the direction that the Aroon suggested.

The main idea behind the Aroon technical indicator is that strong bullish trends will probably experience new highs, and strong bearish trends will probably experience new lows. In essence, it will give you important insights when these new highs and new lows are forming.

Traders can use the technical indicator Aroon to:

- Identify new trends (uptrending or downtrending)

- Assess the strength of the trends

- Identify range zone and consolidations

- Anticipate market reversals

Biggest mistakes traders should avoid when using the Aroon Up/Down indicator

The Aroon indicator is a nifty little tool that traders ought to keep in their day trading arsenal. It is a visual representation of the price action that you can be interpreted easily to make your decision about the direction and momentum of the price. But you can greatly increase the odds of making a profitable trade by implementing a trading strategy around the Aroon indicator by combining it with any other price action based strategies. The indicator is most accurate and useful if used in combination with analysis of price action and other technical indicators, as well as with fundamental analysis if traders place long term trades.

Pros & Cons

The Aroon indicator may at times show a good entry or exit point, but other times it will provide poor or false indications. The buy or sell indication may happen too late, after a substantial price move has already happened. This occurs because the indicator is looking backwards, and isn’t predictive in nature.

A crossover may appear good on the indicator, but that does not mean the price will necessarily make a major move. The indicator is not factoring the size of moves; it only cares about the number of days since a high or low happened. Even if the price is flat, crossovers will occur as eventually a new high or low will be made. Traders still need to use price analysis, and potentially other indicators, to make the best trading decisions. Solely depending on one indicator isn’t advised.

Conclusion

This indicator is an unusual indicator that can help traders detect the strength of a trend and ride that trend until a sell or buy high is reached. The Aroon up and down indicators are versatile. The triangular Aroon oscillator lines make it easier for the novice traders to spot buy and sell signals.

Generally, you have a momentum oscillator that can easily be in your top 3 best technical indicators for profitable trading. The indicators you’re using will affect how you interpret the trends. Of course, no single indicator is the best for trading. Aroon is an effective tool for detecting changes in the trend direction and how strong the trend is.

Good Trading requires the Best Charting Tool!

Good Trading requires the Best Charting Tool!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!

We loved Marwood Research’s course “Candlestick Analysis For Professional Traders“. Do you want to follow a great video course and deep dive into 26 candlestick patterns (and compare their success rates)? Then make sure to check this course!